Lewis/Mertens/Inventory and Baumeister/Leiva-Leon/Sims weekly indicators, and Torsten Slok’s rundown.

Determine 1: Lewis/Mertens/Inventory Weekly Financial Index (blue), and Baumeister/Leiva-Leon/Sims Weekly Financial Situations Index for US plus 2% development (tan), all y/y development price in %. Supply: NY Fed by way of FRED, WECI, accessed 8/10/2024, and creator’s calculations.

Development by each indicators is round development.

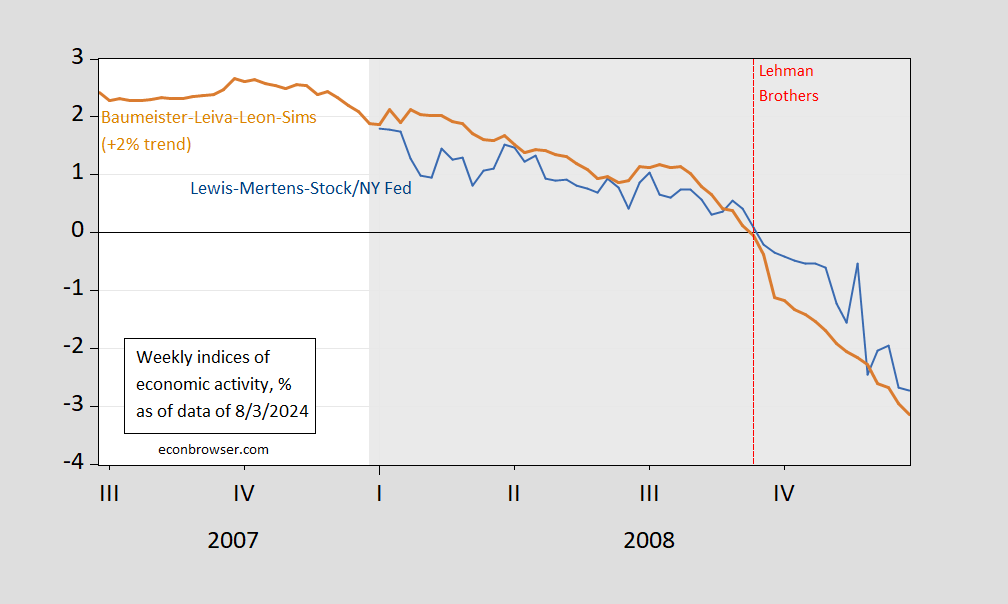

What did these collection appear to be for the interval surrounding the 2008 recession (retaining in thoughts these are the present vintages, not the true time variations):

Determine 2: Lewis/Mertens/Inventory Weekly Financial Index (blue), and Baumeister/Leiva-Leon/Sims Weekly Financial Situations Index for US plus 2% development (tan), all y/y development price in %. Supply: NY Fed by way of FRED, WECI, accessed 8/10/2024, and creator’s calculations.

So, evaluating, it doesn’t look very recessionary for knowledge obtainable as of 8/3.

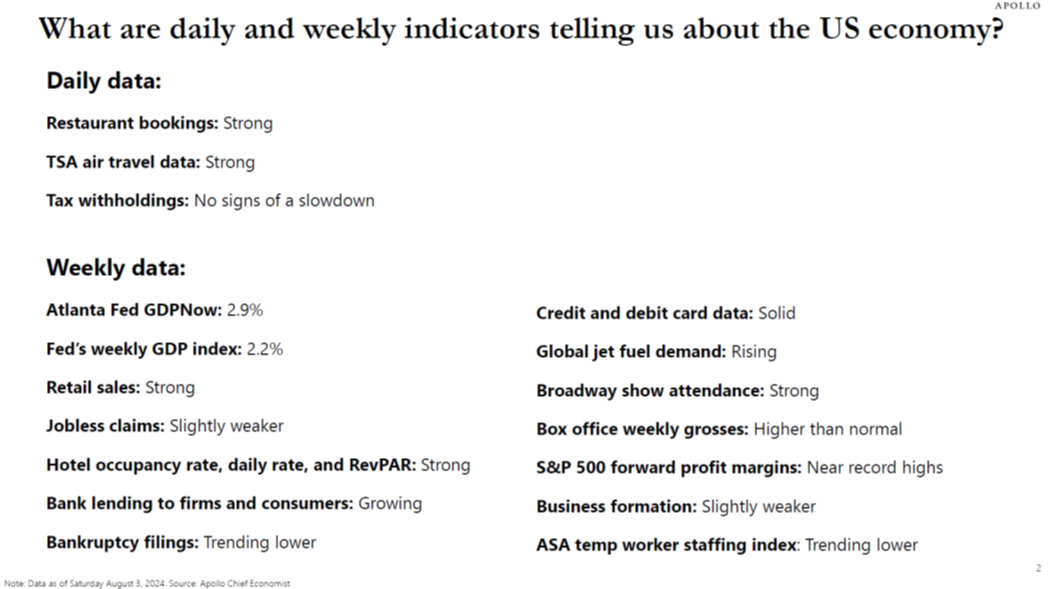

As promised, right here’s Torsten’s abstract of his Day by day and Weekly Indicators for the US Economic system chartbook (launched as we speak):