From the IMF (9/27/2024):

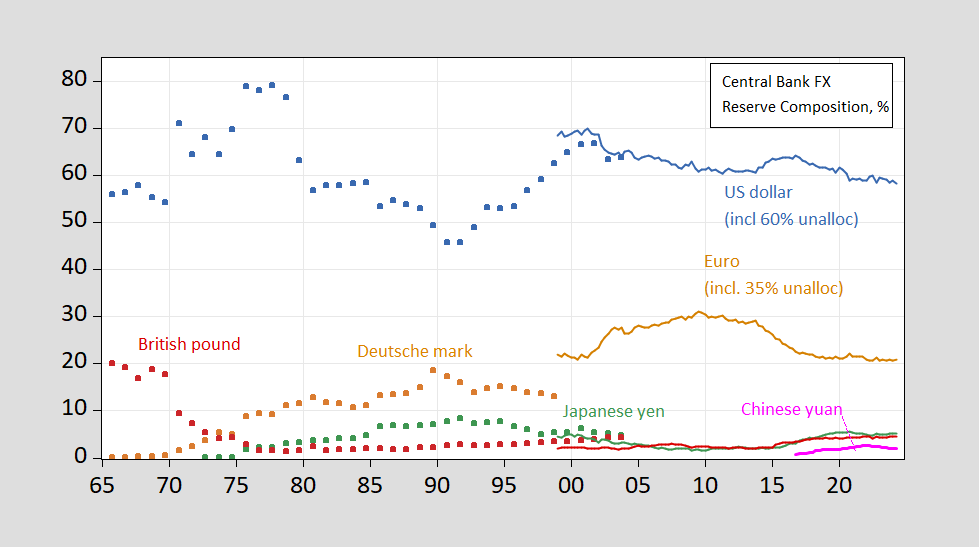

Determine 1: USD share of complete reserves as reported (gentle blue), and USD share plus 60% of unallocated share (daring blue). Supply: IMF, COFER, and writer’s calculations.

Whereas this discount would possibly appears precipitous, it’s fascinating to notice the quicker shift was in the course of the Trump administration. In any case, some context is beneficial.

Determine 2: Share of overseas alternate reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (crimson). For 1999 knowledge onward, estimates based mostly on COFER knowledge, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 10/1/2024, and writer’s estimates.

The lower from 2022Q3 might be accounted for by the lower within the worth of the US greenback (keep in mind the shares are calculated utilizing foreign money values evaluated utilizing market alternate charges). So, a bit untimely to fret in regards to the finish of the greenback’s reserve foreign money hegemony.

For extra on fx reserve holdings, from a central financial institution by central financial institution perspective, see Chinn et al. (2024), mentioned right here.