Immediately we current a visitor publish written by Lindsay Jacobs, Assistant Professor on the Robert M. La Follette College of Public Affairs, on the College of Wisconsin, Madison.

Since 2021, Social Safety retirement advantages have exceeded the income generated by payroll taxes. The shortfall has been lined by drawing from the Social Safety Belief Fund, which is projected to be depleted by 2034. At the moment, we’ll face a “fiscal cliff” for this self-funded program the place payroll taxes will solely cowl about 80% of the advantages, leading to an automated 20% discount in funds to retirees.

Practically all staff and retirees might be affected, so there may be broad curiosity in reforms that might avert this sudden drop in advantages. Nevertheless, this final result is sooner or later, so the dilemma is that whereas any reform is healthier than inaction, every comes with fast prices. Contemplating this, the restricted legislative momentum appears unsurprising.

The Social Safety Administration (SSA) has revealed up to date projections exhibiting how numerous reforms might influence this system’s solvency. You could find a abstract right here, and extra detailed analyses right here. There are dozens of prospects, most being variations on both profit discount or payroll tax will increase. Two incessantly mentioned reforms are elevating the retirement age and elevating or eliminating the payroll tax cap. Different, much less distinguished proposals contain adjusting how advantages and earnings histories are calculated to account for inflation and actual wage development.

For my part, profitable reform will seemingly contain a mixture of approaches to be able to keep this system’s goal of poverty discount in previous age whereas preserving the broad public help that Social Safety has loved.

Right here’s how I’m eager about the tradeoffs of 4 explicit reform prospects—not as a policymaker however merely as an researcher. It’s extra of a novel than I had anticipated, nevertheless it turns on the market’s rather a lot to contemplate!

Reform 1: Elevating the Full Retirement Age

The Full Retirement Age (FRA)—the age at which beneficiaries can obtain their full Major Insurance coverage Quantity (PIA)—was step by step raised from 65 to 67 following important reforms in 1983. Surprisingly, these have been the final main adjustments to this system. Since then, proposals have surfaced to step by step elevate the FRA additional to 68, 69, and even 70, with the rationale being that will increase in life expectancy justify a later retirement age.

This transformation can be fairly efficient in bettering Social Safety’s solvency. For instance, elevating the FRA step by step to age 69 would scale back this system’s shortfall by about 38% over the subsequent 75 years. (Situation C1.4 in SSA’s projections.)

I’d argue that there are further distributional results of accelerating the FRA throughout occupations, given the variations in claiming age conduct and there being a good larger penalty on teams of people that have a tendency to assert early. Particularly, individuals in blue-collar jobs, no matter their revenue stage, are likely to retire earlier and can be extra negatively impacted by an FRA improve. I mentioned this in a previous EconBrowser article and this paper additional explores the problem.

Elevating the FRA will not be an particularly well-liked reform. Whereas it’s successfully a profit lower, as proven beneath, it doesn’t require delaying advantages altogether; the choice to assert advantages earlier than the FRA—on the Early Eligibility Age (EEA) of 62—would nonetheless stay, albeit at diminished ranges. If this level have been emphasised, I feel the thought would possibly face much less resistance.

A rise within the earliest eligibility age can be a far worse final result for many who are already claiming as quickly as potential—notably many blue-collar staff. Elevating the EEA would seemingly even have the impact of directing extra individuals towards making use of for Social Safety Incapacity Insurance coverage (SSDI).

I wouldn’t be in favor of accelerating the FRA dramatically or the EEA in any respect as a result of they make advantages far much less progressive in follow, and fewer according to the aim of this system. A average improve within the FRA to 68 appears agreeable, a minimum of when contemplating the choice of across-the-board profit cuts that might include insolvency.

Reform 2: Growing the Taxable Wage Base

The wage base for Social Safety payroll taxes contains all revenue as much as the present annual most of $168,600, and is taxed at 12.4%, cut up between employers and staff. Any revenue above this cover will not be topic to the tax, and no further advantages are earned. Immediately, about 6% of staff earn greater than this threshold. Whereas advantages are extremely progressive, payroll taxes alone are considerably regressive.

One of many extra formidable proposals to increase the wage base is to elevate the cap completely, taxing all revenue whereas sustaining the present profit system. This might get rid of about 60% of the projected funding shortfall over the subsequent 75 years (as proven in Situation E2.17 in SSA’s projections). A variation of this proposal was included within the Social Safety 2100 Act (H.R. 4583), which might topic revenue above $400,000 to the payroll tax, whereas excluding revenue between $168,600 and $400,000. This creates a “donut gap” that might shrink over time because the taxable most will increase with wage development.

Eliminating the payroll tax cap altogether will surely strengthen the Social Safety program financially however would include many downsides. An actual concern can be the unknown however seemingly very giant labor market results; excessive earners and their employers would absolutely search methods to restructure compensation to keep away from the tax. Even when one have been sympathetic to greater tax charges for greater earners, is Social Safety solvency the best precedence use of these revenues?

One other situation is the potential decline in help for this system. This system is presently very fashionable, partly as a result of advantages are broadly seen as truthful—extremely progressive, however nonetheless linked to taxes paid. Eradicating the cap would weaken the connection between contributions and advantages, which can erode help amongst greater earners. Even when further profit credit have been supplied to these paying greater taxes, this wouldn’t be very interesting to wealthier people who produce other most popular financial savings choices.

One method to mitigate a few of these issues could be to impose a decrease tax fee on revenue above the present cap, which might soften the influence on excessive earners and make the reform extra palatable.

There’s a convincing argument for increasing the taxable wage base, however such a reform would seemingly should be tempered. Presently, 83% of complete labor earnings are topic to Social Safety taxes, down from over 90% within the years following the 1983 reforms. Though the taxable most adjusts for wage inflation, revenue inequality has grown, that means a larger share of earnings now exceeds the cap. A reform that would deal with this situation can be to lift the utmost revenue taxed to cowl 90% of taxes, as a substitute of indexing to development in common wages. This could put the cap at about $300,000 presently. argument towards doing so is that what has pulled up the common earnings will not be a lot the highest 10% of earnings however relatively the share on the very high.

Reform 3: Decreasing the Actual Development of Advantages

One refined however extremely efficient reform would contain adjusting Social Safety advantages utilizing adjustments in general value ranges as a substitute of wage ranges to calculate previous earnings and corresponding advantages. Whereas common wages have outpaced inflation—reflecting actual productiveness development and leading to advantages that develop quicker than the price of dwelling—this reform would gradual that development. Based on the SSA’s projections (Reform B1.1 of their projections), this variation alone might get rid of 85% of the Social Safety shortfall over the subsequent 75 years.

To see why this could have such a big impact, it helps to consider how advantages are calculated. Advantages are based mostly on an individual’s delivery yr, the age at which they declare, and their high 35 years of earnings. These previous earnings are adjusted for wage inflation to find out an individual’s Common Listed Month-to-month Earnings (AIME), which is then used to calculate their Major Insurance coverage Quantity (PIA)—the month-to-month profit they might obtain at Full Retirement Age (FRA). Changes are made if somebody claims earlier or later than their FRA. As a result of nominal wage development is sort of at all times greater than value inflation attributable to rising actual productiveness, the cumulative results of transitioning to cost inflation-based changes would considerably gradual the expansion of advantages over time. Whereas we’d all desire extra salient reforms, the complexity of this reform would possibly—nevertheless unlucky—truly make it extra politically possible.

The conceptual argument for this reform is that the present wage-level changes to advantages are extreme, growing retirees’ advantages effectively past buying energy.

An argument towards it’s that as productiveness rises, retirees ought to share within the beneficial properties from rising dwelling requirements by means of advantages linked to wage development. In spite of everything, if individuals might have as a substitute invested what they paid in Social Safety taxes over time, their returns can be greater than inflation.

I’m keen on each traces of reasoning. Nevertheless, I feel the first benefit of this reform is that it’s merely very efficient at bettering solvency whereas additionally disbursing prices over time.

Reform 4: Modifying the PIA Method to Scale back Advantages for Larger Earners

One other potential reform is to switch the Major Insurance coverage Quantity (PIA) system in a means that reduces advantages for all however the lowest earners. This could defend lower-income retirees from across-the-board profit reductions, whether or not these consequence from elevating the Full Retirement Age (FRA), altering how previous earnings are calculated, or any variety of different reforms. It might additionally considerably enhance Social Safety’s solvency.

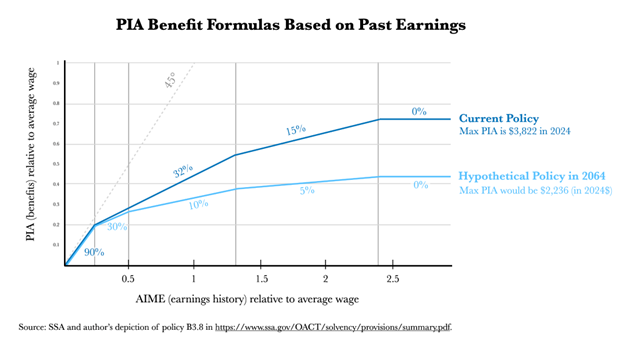

To see what this appears to be like like, I graphed the present PIA “bend factors” and elements, alongside the reform projection in B3.8, which might step by step modify the PIA system over 4 a long time and get rid of 29% of this system’s shortfall over the subsequent 75 years.

This could make this system much more progressive, which might understandably cut back help because it weakens the hyperlink between the taxes individuals pay and what they will anticipate to obtain.

Regardless of this, it appears cheap on the grounds that it will go a great distance in bettering solvency, whereas aligning extra carefully with this system’s unique goal of decreasing poverty at older ages.

Furthermore, implementing the adjustments over an extended time horizon would give those that are able to saving to regulate their plans effectively prematurely of retirement—very fascinating when contemplating the choice of sudden and unsure drops in advantages.

Selecting the Least Worst Choices

In the end, I feel the objectives of Social Safety reforms ought to embody:

- Attaining solvency to fulfill present obligations and supply certainty for future retirees.

- Making certain revenue alternative and safety towards poverty in previous age, in alignment with this system’s unique objectives.

- Preserving the broad help Social Safety has historically loved.

Given these targets—and contemplating the truth that the choice isn’t any reform, which is able to result in sudden profit cuts—I’d advocate for a mixture of the next: decreasing advantages for top earners over time (Reform 4), adjusting how previous earnings are listed (Reform 3), and reasonably growing the taxable wage base (Reform 2). Taken collectively, a extra tempered model of every may very well be carried out to realize solvency.

Of those, the simplest in reaching these objectives would seemingly be decreasing advantages for greater earners (Reform 4), carried out step by step. Some type of this could align Social Safety extra carefully with its unique intention as a “security web” aimed toward stopping poverty in previous age, relatively than a full retirement financial savings program. As a result of individuals with greater earnings histories have a tendency to save lots of way more privately, a discount in advantages could be most popular to payroll tax will increase which may in any other case come up.

A average improve within the taxable wage base, protecting nearer to 90% of complete earnings, contributes very successfully to this system’s fast solvency. Since adjustments to the profit system would take time to section in, a minimum of some near-term tax will increase are obligatory. Adjusting how previous earnings are listed—shifting towards a measure between wage and value inflation—would additionally assist obtain solvency whereas being extra impartial than different types of profit reductions.

With these choices obtainable, I wouldn’t favor elevating the Full Retirement Age (Reform 1), because it disproportionately impacts those that for numerous causes declare earlier, notably these in bodily demanding jobs, and would seemingly improve reliance on Incapacity Insurance coverage (SSDI), which I’ve checked out right here.

The final important reforms in 1977 and 1983 occurred inside a yr of insolvency—so is that what we must always anticipate? Maybe, however the sooner reforms come, the higher. For legislators, nevertheless, advancing disagreeable however obligatory reforms are a largely thankless job with many downsides. This might change if a large share of voters present concern. However this could require accepting the truth of no reform: Our present coverage is an instantaneous discount of 20% in advantages for all in solely 10 years, a discount that can solely develop over time. With out this unlucky different in thoughts, after all no reform appears to be like interesting!

So, what do you suppose?

This publish written by Lindsay Jacobs.