Industrial and manufacturing manufacturing down at consensus price (-0.3% m/m for each). Core retail gross sales +0.1% vs. consensus +0.3% m/m. First up, collection adopted by the NBER’s Enterprise Cycle Courting Committee (private revenue and employment are key):

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q3 1st launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 launch), and writer’s calculations.

I don’t embrace adjustment for climate associated unemployed that may be ascribed to hurricanes; for this quantity in October, see Determine 1 on this put up.

And listed here are some different indicators (on the identical vertical scale for comparability):

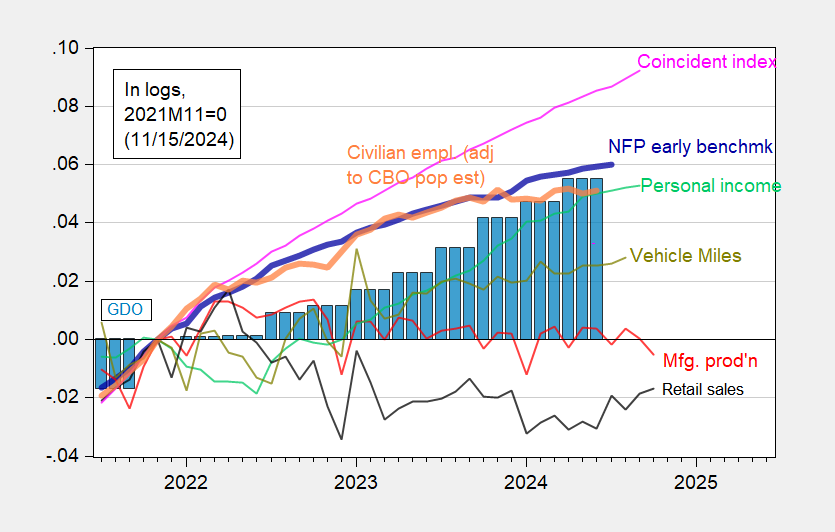

Determine 2: Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates by way of mid-2024 (orange), manufacturing manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (gentle inexperienced), retail gross sales in 1999M12$ (black), automobile miles traveled (VMT) (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Supply: Philadelphia Fed, Federal Reserve through FRED, BEA 2024Q2 third launch/annual replace, and writer’s calculations.

Be aware that retail gross sales (deflated by chained CPI) has risen from 2024H1 lows.

Clearly, industrial manufacturing and manufacturing manufacturing are indicating a downturn. Nevertheless, industrial manufacturing contains solely about 17% of worth added, so it’s not as a lot an indicator of the broad financial system as up to now.

Addendum:

See Jan Groen’s notes right here on the implications of this week’s releases for the enterprise cycle.

As of in the present day, GDPNow for This fall at 2.5%, NY Fed nowcast at 2.0, Goldman Sachs at 2.5%.