Right this moment, we’re happy to current a visitor contribution written by Joshua Aizenman (College of Southern California) and Jamel Saadaoui (Université Paris 8-Vincennes). This publish relies on the paper of the identical title.

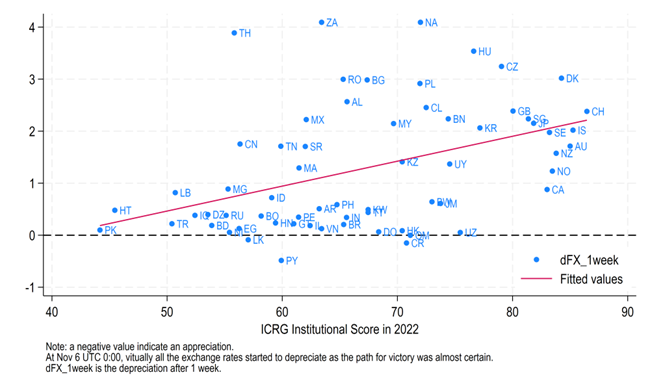

The result of the 2024 US presidential election has resonated all world wide. On the change charge markets, just about all of the change charges of nations that aren’t pegged depreciated in opposition to the USD round midnight November 6, 2024, when the end result of the election was sure. To grasp higher the components accounting for these depreciations, we compute three measures of change charge depreciations: first, the utmost depreciation throughout the 1st buying and selling day after November 6 UTC 0:00 to seize the response on the FOREX instantly after the information the utmost depreciation throughout the first buying and selling day; second, the depreciation after 4 days to seize the response of financial authorities and monetary markets to the shock; third, the depreciation 1 week after the shock to look at whether or not some change charges skilled an additional depreciation or a return to the pre-shock change charge degree. Determine 1 plots the patterns of those 3 depreciations. Notably, the change charge motion noticed instantly after the 2024 US election has not been reversed one week later. In 26 nations out of a pattern of 73 bilateral change charges in opposition to the US Greenback, the depreciation after 1 week was much more pronounced than simply after the election. Amongst them, we discover South Africa, Thailand, Hungary, Czech Republic, Romania, Bulgaria, and Poland, because the nations with the most important variations. These actions are on the coronary heart of policymakers’ discussions, as they create instability, particularly for rising markets.

Determine 1. Alternate charge actions within the aftermath of the 2024 US election

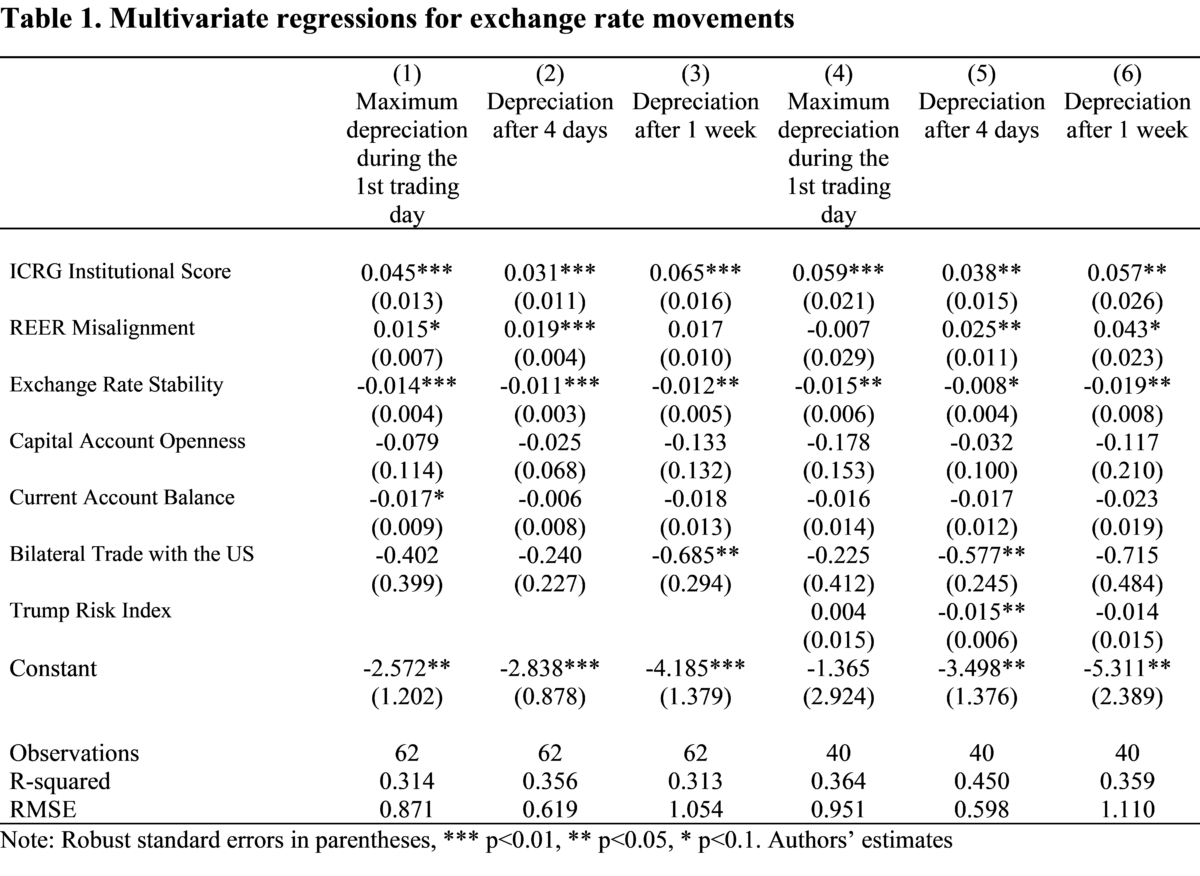

The result of the 2024 US election gives us a quasi-natural experiment to check the resilience of nations to exchange-rate market pressures. Certainly, as a result of nature of the Republican platform and because of the usage of high-frequency knowledge, we will determine the components that specify the cross-sectional variations in forex returns in opposition to the US Greenback. In Determine 2, we plot the change charge actions in opposition to the USD one week after the information in opposition to the ICRG institutional rating, a broad measure of the standard of establishments created and maintained by the PRS group. For our pattern of 73 currencies in opposition to the USD, we discover that the correlation between the depreciation charge and the institutional rating is clearly optimistic round 40 %, and important on the 1 % degree. This correlation could point out that the market expects that the brand new US administration will likely be extra favorable or a minimum of extra impartial vis-à-vis nations with political regimes which are much less cautious about a number of dimensions of institutional improvement, just like the respect of property rights, the central financial institution independence, the transparency of financial and monetary coverage, democratic accountability of the financial coverage choices and so forth.

Determine 2. Correlation between establishments and change charge actions

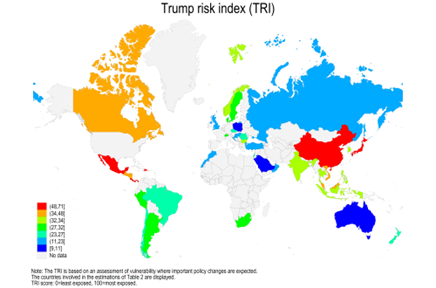

With a purpose to obtain extra dependable estimates, we run multivariate regressions, controlling for a vector of related confounding variables. Desk 1 gives a number of insights. First, nations with higher establishments expertise stronger depreciation. Second, change charge interventions (proxied by change charge stability scores) have helped to stabilize the currencies in any respect time horizons. Third, misalignment of the actual efficient change charge contributes to the change charge depreciation solely after 4 days. This coefficient can mirror an error-correction mechanism, as overvalued currencies are anticipated to depreciate sooner or later. Fourth, the bilateral commerce surplus with the US contributed to the depreciation after 4 days. Greater publicity to the chance linked to anticipated adjustments within the US coverage, measured by the EIU’s Trump Danger Index (see Determine 3), contributes to limiting the depreciation after 4 days. This presumably displays the remark that the majority uncovered economies have skilled the most important actions instantly after the shock (in keeping with dynamics steered by Larson and Madura, 2001. ‘Overreaction and underreaction within the international change market.’ World Finance Journal).

Determine 3. The Trump Danger index

Supply:The Economist.

This publish written by Joshua Aizenman and Jamel Saadaoui.