Yves right here. This publish discusses the widespread assumption that if Trump strikes ahead together with his plan to impose across-the-board tariffs on America’s three greatest commerce companions, that will probably be inflationary and the Fed will probably be pressured to reply by way of rising rates of interest. This text contends that increased charges make sense provided that US commerce companions don’t (one assumes meaningfully) retaliate. Easing could wind up being so as if tariffs to scale back US development.

By Paul Bergin, Professor of Economics College of California, Davis and Giancarlo Corsetti, Pierre Werner Chair and Joint Professor, Division of Economics and Robert Schuman Centre for Superior Research European College Institute. Initially printed at VoxEU

Donald Trump’s victory within the latest US presidential election has re-ignited a debate over the macroeconomic results of tariffs and the suitable financial coverage response. This column argues that even when there may be broad settlement that new tariffs would seemingly be inflationary for the US, the present state of affairs presents numerous elements which counsel that it is likely to be optimum for coverage to focus extra on the inefficient fall in output.

The outcomes of the latest US presidential election re-ignited a debate over the macroeconomic results of tariffs, and the suitable financial coverage response to a commerce battle. Through the first Trump administration, US tariffs on Chinese language exports rose seven-fold between 2018 and 2020, they usually remained excessive underneath the Biden administration. Extra to the purpose, world political developments level to a big weakening of worldwide consensus concerning free commerce and herald a brand new atmosphere during which central banks could face this new sort of shock with rising frequency.

A lot of latest analysis on the macroeconomic results of commerce coverage shocks has been performed within the context of actual commerce fashions, or in empirical workout routines with out consideration of financial coverage. 1 However the penalties of commerce frictions clearly problem central banks: how ought to they reply to a backwards step within the progress in direction of rising commerce integration, with probably important results on inflation, financial exercise, exterior balances, and actual trade charges? In a latest paper (Bergin and Corsetti 2023), we examine the optimum financial coverage responses to tariff shocks of varied sorts. On this column, we replace the evaluation and distill classes acceptable to the present state of affairs.

In our paper, we examine the optimum financial coverage responses to tariff shocks utilizing a regular workhorse open-economy New Keynesian (sticky-price) mannequin augmented with worldwide worth chains in manufacturing, i.e. imported items are used within the manufacturing of home items and exports. This means that elevating tariff safety of home exporters raises the price of manufacturing for home companies. All through our evaluation, we assume a share of imported inputs in manufacturing near estimates based mostly on the US enter–output tables for 2011 (however we additionally confirm our major conclusions various this share). Our major evaluation assumes substantial go by way of of tariffs to shopper costs, however we additionally reveal robustness of our major outcomes to enriching the mannequin with a distribution sector that limits pass-through. Lastly, we posit that financial authorities don’t make the most of cross-border spillovers to pursue beggar-thy-neighbour insurance policies, i.e. we rule out opportunistic manipulation of the trade fee. 2

To sum up our major message: even when there may be broad settlement that new Trump tariffs will seemingly be inflationary for the US, it’s removed from apparent that the optimum response of financial coverage to those tariffs ought to deal with combating these inflationary results by way of financial contraction. Tariff shocks mix parts of each demand and provide disturbances, and financial coverage is sure to face a troublesome trade-off between moderating inflation and supporting financial exercise; in actual fact, an affordable calibration of our mannequin signifies that the optimum financial response to such a state of affairs could properly contain financial growth. Our evaluation underscores that, whereas the optimum financial response to tariffs depends upon a number of elements, a key function is performed by (i) the probability that the tariffs are reciprocated in a commerce battle, (ii) the diploma of reliance of home manufacturing on imported intermediates, and (iii) the particular function of the US greenback because the dominant forex for invoicing worldwide commerce. We focus on completely different instances in flip.

The Case for Financial Tightening: Unilateral tariffs With out Retaliation

Allow us to take into account first the rationale for financial tightening. This might be clear in a state of affairs during which the US unilaterally imposes a tariff on home purchases of overseas items to spice up demand for home items, inflicting inflation within the value paid by home shoppers and producers utilizing imported inputs.

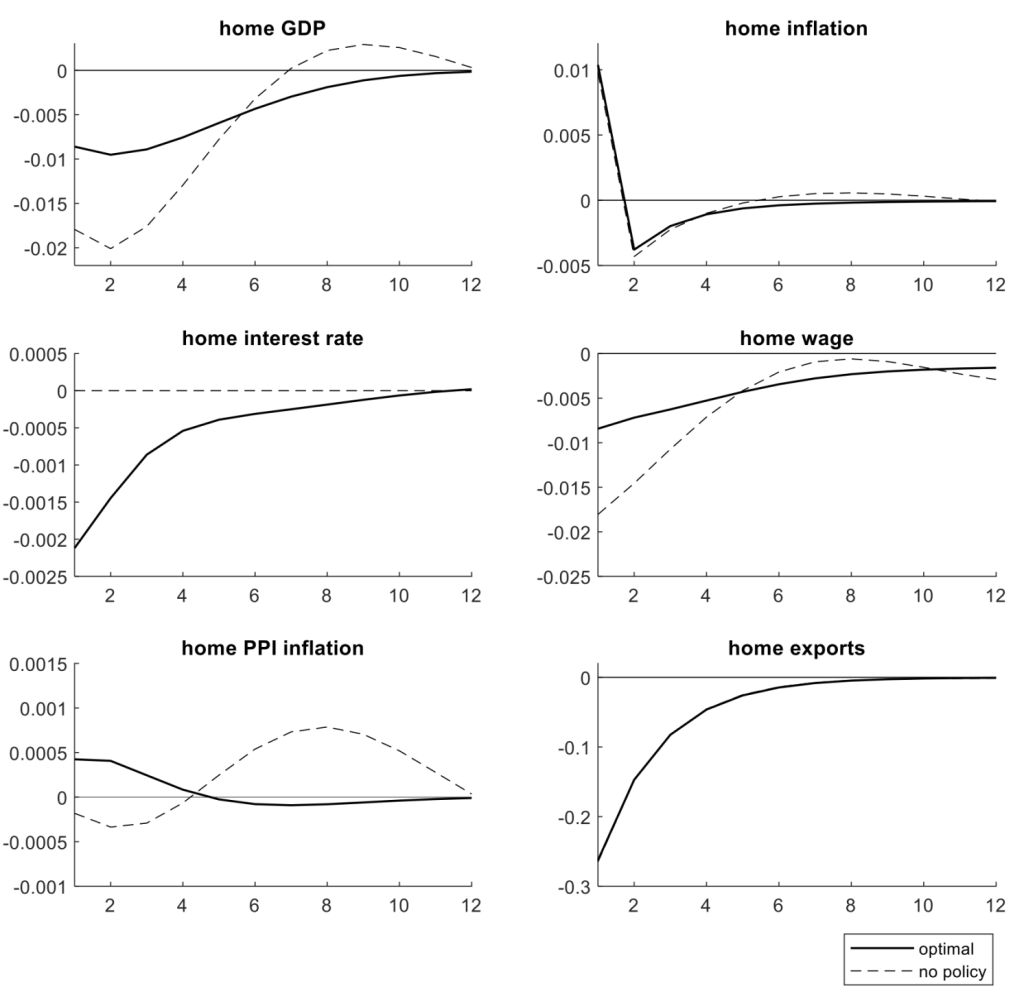

In Determine 1, we use our mannequin to hint the results of a unilateral tariff shock. The dashed strains hint the impact of such a shock over time whereas holding coverage charges fixed: GDP and inflation rise within the US, however they transfer in the other way within the US’ commerce companion (the overseas nation). On the ongoing trade fee, the US commerce steadiness turns right into a surplus.

Determine 1 Unilateral tariff on residence imports

Be aware: Vertical axis is % deviation (0.01=1%) from regular state ranges. Horizontal axis is time (in quarters).

Taking a look at these baseline outcomes, a coverage of financial contraction at residence (US) may be motivated by a have to average inflation – equivalent to financial growth overseas to average deflation. However an extra motivation may be present in the truth that the divergence within the residence and overseas coverage stance works to understand the house forex, which may serve to decrease the efficient value of overseas items that residence shoppers see, and thus partly offset the distortionary impact of the tariffs on relative costs.

These concerns underlie the behaviour of macro variables underneath the optimum coverage, traced as a stable line within the determine. The US financial authorities curb inflation, which in our case serves additionally to average the home rise in output. The autumn in demand and the greenback appreciation scale back the commerce surplus considerably. Overseas, financial authorities assist exercise at the price of inflation, contributing to correcting partially the worldwide relative value of products distorted by the tariff. 3

As we present in our paper, the conclusions to date stay legitimate additionally when the diploma of trade fee go by way of is low throughout all borders, i.e. costs are sticky within the forex of the export vacation spot nation. A low go by way of reduces the impact of forex depreciation on relative costs, and financial coverage can’t depend on forex depreciation to redirect world demand in direction of personal traded items. But, in response to a unilateral tariff, the optimum stance continues to be contractionary at residence and expansionary overseas.

The Case for Financial Expansions: Commerce Wars

The place our paper is extra progressive is in displaying that the optimum coverage is mostly expansionary within the case of a symmetric tariff battle – say, if the overseas nation retaliates with equal tariffs on imports of US items. On this case, the US experiences not solely increased inflation but in addition a drop in output, pushed by the autumn in world demand induced by the hike in commerce prices. Commerce wars current policymakers with a selection between moderating headline inflation with a financial contraction, or as an alternative moderating its detrimental impression on output and employment with a financial growth.

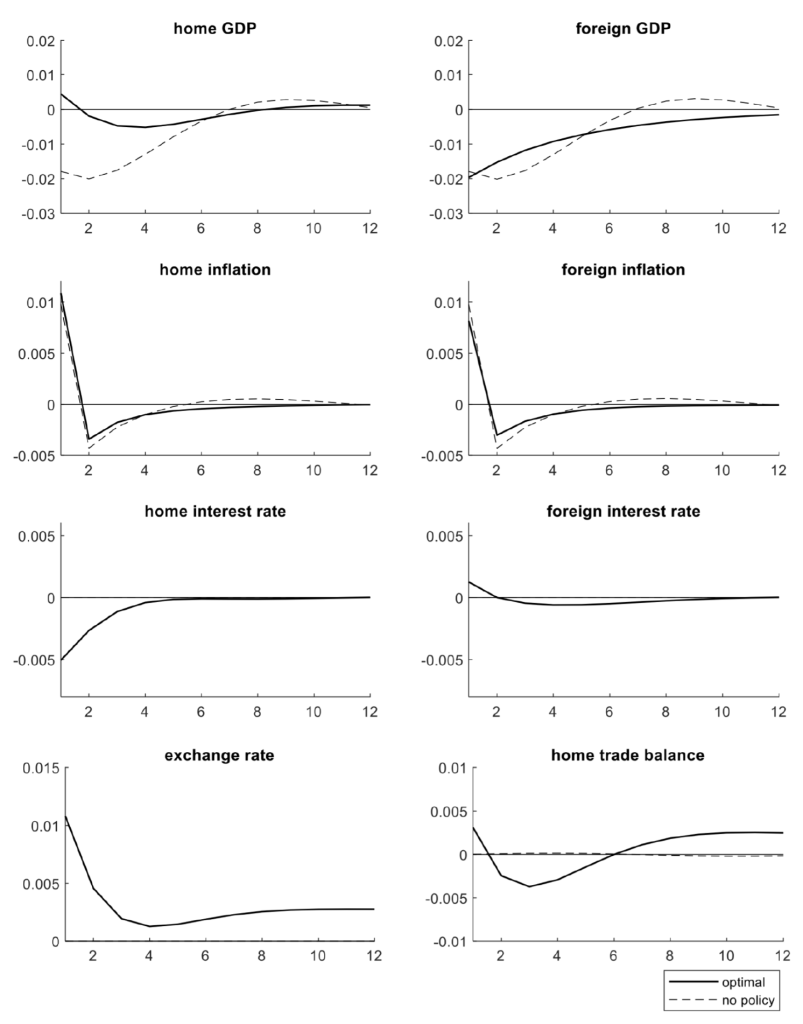

The trade-off confronting central banks is illustrated by the dashed strains in Determine 2, drawn for a symmetric battle, underneath the assumptions that the go by way of of the trade fee on border costs could be very excessive. The contractionary results of the tariff battle embrace a deep drop in gross exports worldwide. Inflation spikes, whereas output falls.

Determine 2 Symmetric tariff

Be aware: Vertical axis is % deviation (0.01=1%) from regular state ranges. Horizontal axis is time (in quarters).

A trade-off between inflation and unemployment is clearly not unfamiliar to policymakers. If it had been generated by a regular provide shock – say, a fall in productiveness – customary macro fashions would counsel optimum coverage would select financial contraction to stabilise inflation. Nevertheless, as careworn in our evaluation, tariffs are fairly completely different from a regular productiveness shock, in that they mix parts of provide shocks with demand shocks, and the optimum coverage consequently tends to be fairly completely different. One approach to see that is that whereas a tariff battle raises the common value of all consumption items, together with imports, the contraction in world demand tends to scale back the costs set by home companies. In different phrases, tariffs increase CPI inflation however are likely to depress PPI inflation. In a retaliatory commerce battle, it’s optimum to increase and stabilise PPI inflation regardless of the hike in CPI inflation hitting shoppers. That is proven by the stable strains in Determine 2, drawn for one nation (the conclusion applies symmetrically after all to all nations participating within the commerce battle).

Whereas we’ve got demonstrated above that tariff shocks are fairly completely different from productiveness shocks, additionally it is vital to not confuse tariff shocks with cost-push markup shocks. First, a house tariff shock solely impacts the costs of imported items, whereas markup shocks are usually envisioned as affecting domestically produced items. Second, the income generated by a tariff shock accrues to the importing nation, whereas the earnings from increased markups go to companies within the exporting nation. Third, tariffs are imposed straight on the customer, thus added on high of the value set by the exporter. Our mannequin highlights the distinctive nature of tariff shocks relative to those different provide disturbances; even whereas financial contraction is the optimum response to opposed productiveness or markup shocks within the context of our mannequin, financial growth is the optimum response to a tariff shock producing inflation.

Our evaluation totally accounts for the truth that manufacturing within the US makes use of a excessive share of imported intermediate inputs, i.e. increased manufacturing prices amplify the supply-side implications of the tariff relative to the demand implications. Certainly, in our quantitative workout routines, we discover that the optimum response to a commerce battle turns into contractionary at a very excessive share of imported intermediate inputs in manufacturing. However based mostly on enter–output estimates of this share (and intensive robustness evaluation during which we range the share), we consider that our benchmark conclusion (prescribing an expansionary financial stance) may be anticipated to be extra related empirically.

The ‘Privilege’ of Issuing the Dominant Forex in Worldwide Commerce

The US greenback has a particular function because the dominant forex utilized in worldwide commerce of products. It’s well-known that if the costs of imports in all nations are sticky in greenback items, the US (the dominant forex nation) can rely to a a lot bigger extent on financial coverage as a stabilisation software. That’s, it needs to be in a greater place to redress the distortionary results of the tariff shock on personal output and employment, with related implications for the remainder of the world.

Contemplate first a tariff battle, depicted in Determine 3 (once more, the dashed strains hint the no-policy state of affairs, the stable strains the optimum coverage state of affairs). On impression, the battle is a worldwide contractionary shock. Within the dominant forex nation, the optimum financial response is now comparatively extra expansionary, because the nationwide financial authorities can redress the shortage of worldwide demand with out feeding the inflation of imported inputs on the border – imports in {dollars} transfer little or no with a greenback depreciation. An growth within the dominant-currency nation is nice information for the opposite nation: it incorporates the autumn in world demand and reduces imported inflation there (a greenback depreciation implies that importers overseas pay a less expensive value in home forex on the border). Due to this, even when the tariffs hikes are completely symmetric, the opposite nation is in a distinct place. Moderately than matching the growth within the US, it resorts to a gentle upfront contraction to include inflation. Be aware that, whereas GDP falls in each nations, it falls by much less within the nation issuing the dominant forex. The US greenback depreciates on this state of affairs.

Determine 3 Symmetric tariff, residence points the dominant forex in commerce

Be aware: Vertical axis is % deviation (0.01=1%) from regular state ranges. Horizontal axis is time (in quarters).

As we mentioned above, within the case that the tariff is unilaterally imposed by the dominant forex nation, the worldwide demand for exports by this nation doesn’t endure the results of a retaliatory tariff. Therefore, inflation turns into a extra urgent concern for financial authorities – the optimum stance is contractionary. The contraction can now be stronger, as a result of the greenback appreciation has extra muted crowding-out results on US items within the worldwide market. The stronger contraction has world repercussions. Overseas the optimum stance turns into expansionary – to immediate home demand vis-à-vis falling exports to the US – tolerating inflation and exacerbating forex depreciation. The US greenback appreciates sharply on this state of affairs.

Conclusions

Tariff shocks could current policymakers with a very troublesome selection between moderating inflation and the output hole. A number of elements of the present state of affairs counsel that, even whereas tariffs are more likely to be inflationary, it is likely to be optimum for coverage to focus extra on the inefficient fall in output. These elements embrace the probability that US tariffs could possibly be reciprocated in a tariff battle, the truth that present tariff threats appear centred extra on last consumption items slightly than intermediate inputs in home manufacturing, and the truth that the US greenback has an uneven place in world commerce as a dominant forex.

See authentic publish for references