January NFP employment progress surprises on the upside, at +275 vs. +198 hundreds consensus. With mixed downward revisions within the prior two months totaling 168 thousand, the extent of employment is nearly per implied consensus. Right here’s an image of key indicators adopted by the NBER’s Enterprise Cycle Relationship Committee, plus month-to-month GDP and GDPNow.

Determine 1: Nonfarm Payroll employment incorporating benchmark revision (daring darkish blue), implied stage utilizing Bloomberg consensus as of two/1 and December 2023 NFP (blue +), civilian employment (orange), industrial manufacturing (purple), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, third launch (blue bars), GDPNow for 2024Q1 as of three/7 (lilac field), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2023Q4 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/1/2024 launch), and writer’s calculations.

Whereas the official NFP sequence exhibits continued progress, there’s some slower progress evidenced in different measures.

Determine 2: Nonfarm payroll employment from February launch (daring purple), implied stage from preliminary benchmark by writer and Bloomberg consensus change for February (gentle purple +), Philadelphia Fed early benchmark (gentle inexperienced), family survey sequence on civilian employment adjusted to NFP idea as reported (pink), and QCEW coated employment for US whole (chartreuse), seasonally adjusted utilizing X-13 (in logs). Supply: BLS by way of FRED, BLS, Philadelphia Fed.

The civilian employment sequence (from the family survey) adjusted to the NFP exhibits a particular decline (reflecting partially the civilian employment in Determine 1). How a lot credence to place on this sequence? I’d say lower than that from the CES.

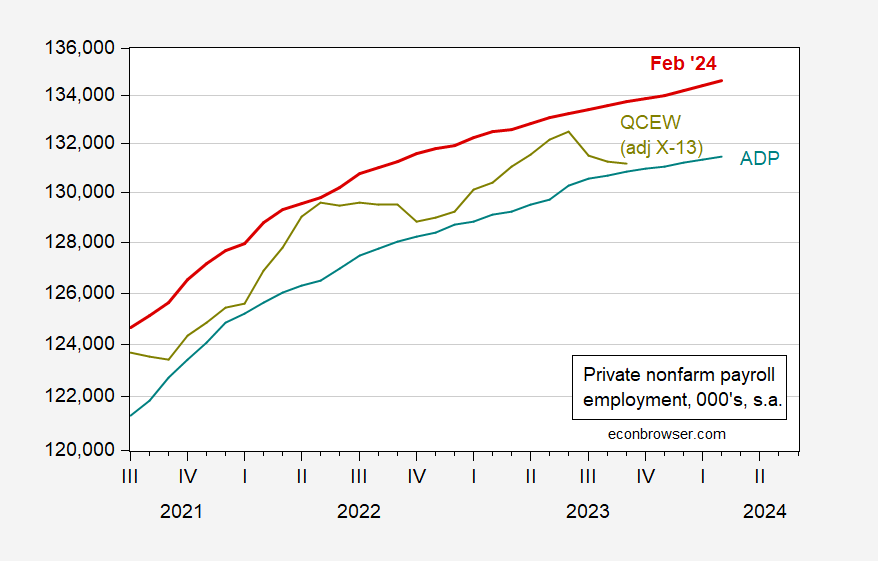

I say this due to the tendencies in unbiased sequence, together with the ADP sequence, and to a lesser extent the QCEW coated employment for personal sector.

Determine 4: BLS Personal nonfarm payroll employment (purple), ADP (teal), and QCEW (chartreuse). Supply: BLS, ADP by way of FRED, BLS, and writer’s calculations.

Onerous to see the slowdown displaying up within the labor market knowledge (placing acceptable weight on CES vs CPS). No recession but in line with the Sahm rule.