Employment nonetheless outstripping the November Wisconsin DoR forecast, primarily based on SPGMI nationwide outlook.

Determine 1: Wisconsin nonfarm payroll employment (black), DoR forecast (tan +), implied from SPF forecast, 000’s, s.a. Supply: DWD, Wisconsin Dept. of Income (Nov.), SPF and creator’s calculations.

The Wisconsin Financial Outlook forecast from November was primarily based on the slowdown on the nationwide stage constructed into the S&P World Market Insights forecast from that month. To the extent that the slowdown has not materialized, it’s not shocking that the forecast is being outperformed.

The SPF implied forecast is predicated on 2021M07-2024M01 regression in first variations, which signifies each proportion level improve in US nonfarm payroll employment is related to a 0.76 proportion level improve in Wisconsin employment (R2 of 0.41). (SPF forecast interpolated to to month-to-month through quadratic match.)

One can fairly ask if the BLS/DWD collection is mismeasuring employment attributable to issues with the agency beginning/loss of life mannequin, and so on. The Philadelphia Fed offers another estimate primarily based on QCEW knowledge by Q3. This collection is even greater than the official collection.

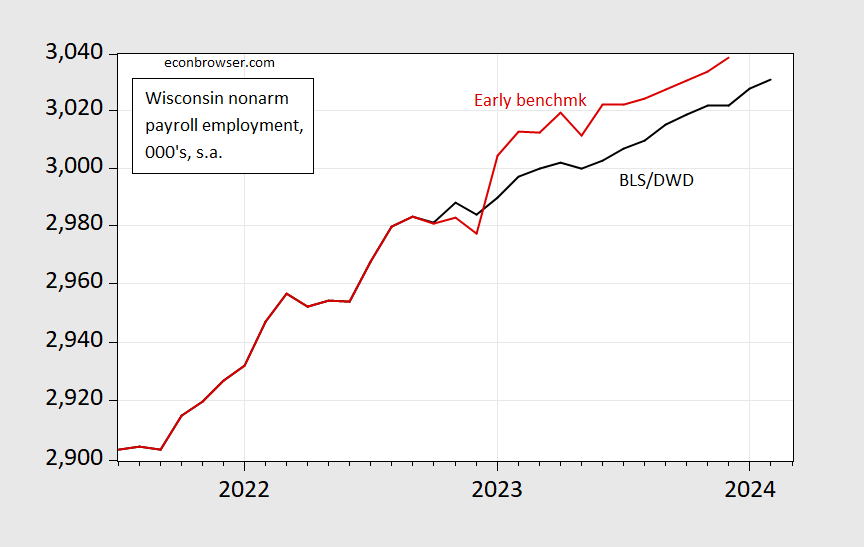

Determine 2: Wisconsin nonfarm payroll employment (black), Philadelphia Fed early benchmark collection (pink), 000’s, s.a. Supply: DWD,Philadelphia Fed.

By the top of 2023, the Philadelphia Fed collection exhibits 2% y/y progress, in comparison with 1.3% utilizing the official collection.

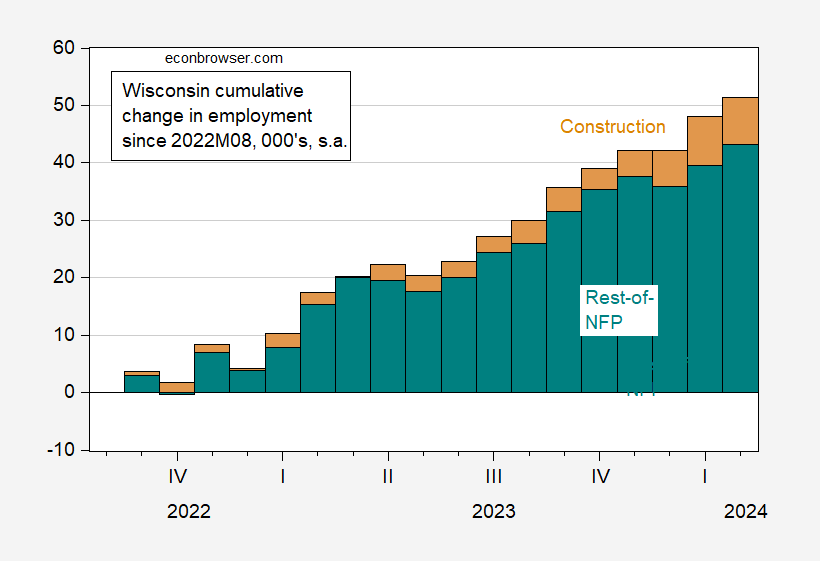

Lastly, development employment has slowed its torrid tempo in February.

Determine 3: Wisconsin cumulative change in development employment (tan), and in rest-of-NFP (teal) since 2022M08, in 000’s, s.a. Supply: DWD and creator’s calculations.