The WSJ April survey is out (responses April 5-9):

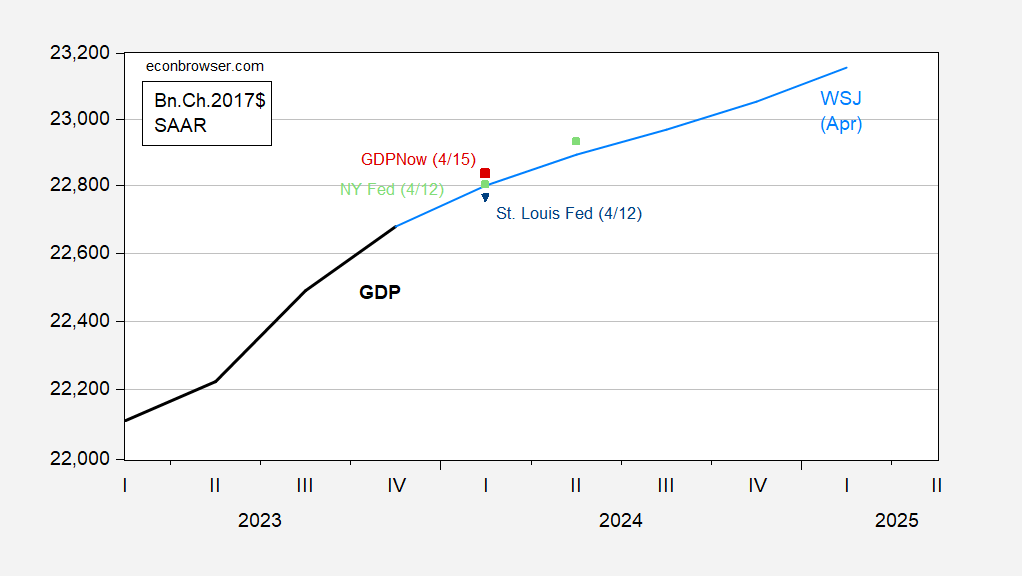

First, the extent of forecasted GDP during the last 3 surveys (7 months):

Determine 1: GDP (daring black), WSJ April 2024 imply forecast implied degree (blue), January 2024 (purple), October 2023 (mild inexperienced), all in bn.Ch.2017$ SAAR. Supply: BEA 2023Q4 third launch, WSJ surveys (numerous points), and creator’s calculations.

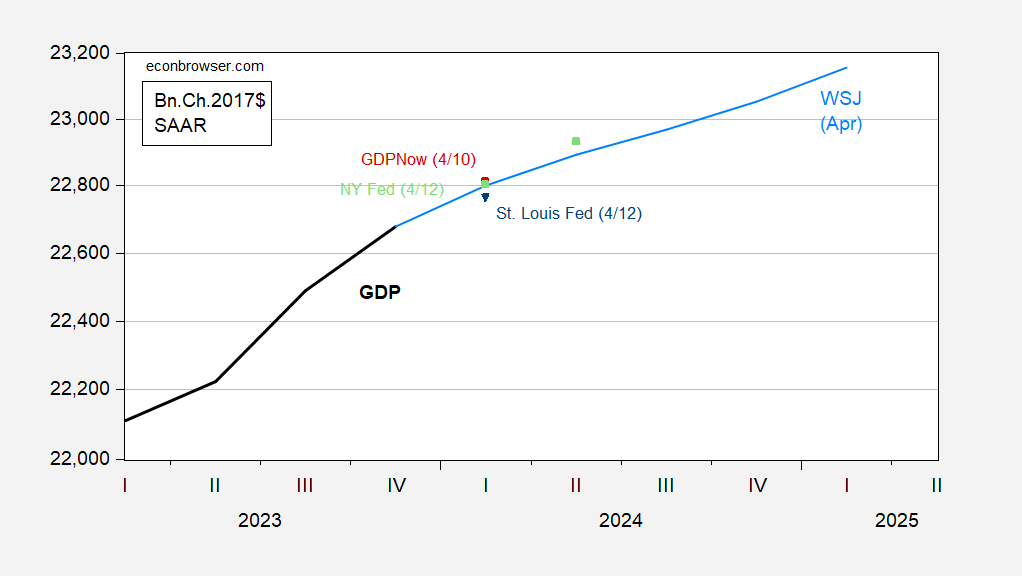

At present, the imply forecast for Q1 is exceeded by two of the newest nowcasts (Atlanta, NY Feds):

Determine 2 [upated]: GDP (daring black), February SPF (mild blue), GDPNow (4/15) (purple sq.), NY Fed (mild inexperienced sq.), St. Louis Fed (blue inverted triangle), all in bn.Ch.2017$ SAAR. Supply BEA through FRED, Philadelphia Fed, Atlanta Fed, NY Fed, St. Louis Fed through FRED, and creator’s calculations.

Determine 2: GDP (daring black), February SPF (mild blue), GDPNow (4/10) (purple sq.), NY Fed (mild inexperienced sq.), St. Louis Fed (blue inverted triangle), all in bn.Ch.2017$ SAAR. Supply BEA through FRED, Philadelphia Fed, Atlanta Fed, NY Fed, St. Louis Fed through FRED, and creator’s calculations.

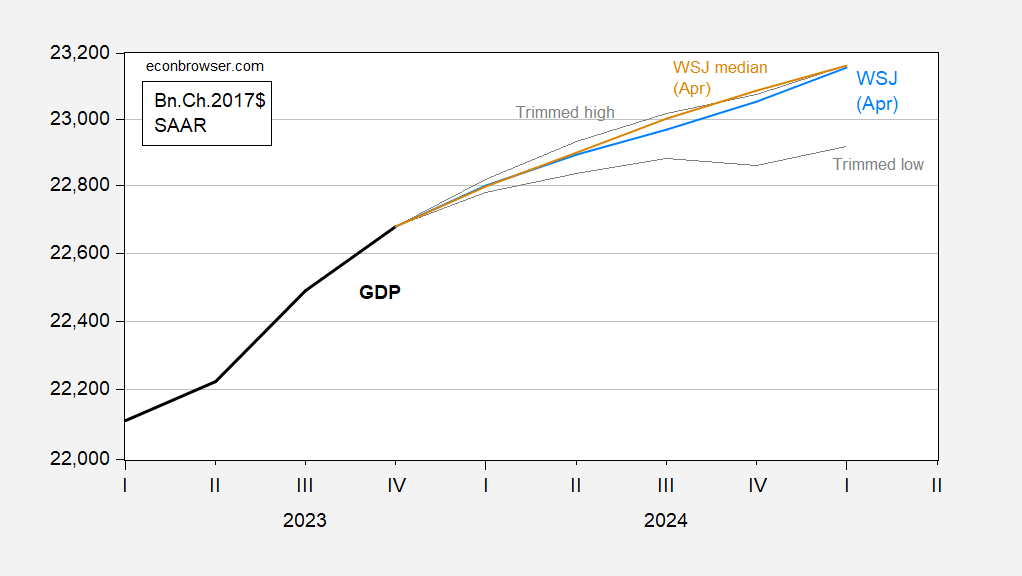

The imply and median forecasts are for no destructive quarters of development. Even the trimmed decrease certain (taking off the underside 6 forecasts for 2024) doesn’t present two consecutive destructive quarters.

Determine 3: GDP (daring black), WSJ April 2024 imply forecast implied degree (blue), median (tan), 20% trimmed excessive/low for 2024 (grey), all in bn.Ch.2017$ SAAR. Supply: BEA 2023Q4 third launch, WSJ surveys (numerous points), and creator’s calculations.

Trimmed low is Mike Cosgrove/Econoclast, excessive is Music Received Sohn/SS Economics. Median is Satyam Panday/S&P International Rankings.

The very best development fee forecast is perennial optimist James Smith/EconForecaster (3.3% if 2024 this fall/this fall). Andrew Hollenhorst & Veronica Clark/Citigroup and Amy Crew Cutts/AC Cutts each forecast destructive development in Q2-Q3.

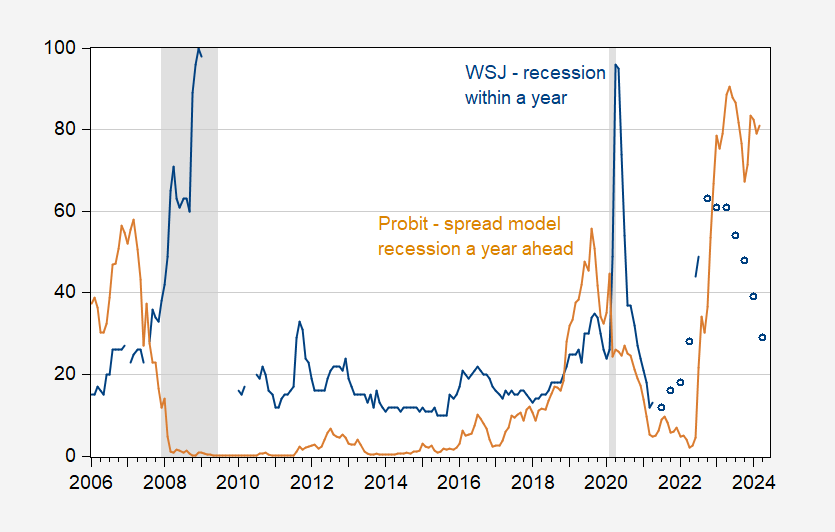

As for recession (recall, NBER doesn’t outline a recession by the two-quarters-consecutive-negative-GDP-growth rule-of-thumb), economists views diverge considerably from a purely statistical prediction (probit) based mostly on the 10yr-3mo time period unfold and the WSJ survey.

Determine 4: WSJ survey likelihood of recession inside one yr (blue), and probit based mostly 10yr-3mo unfold recession in one yr (tan), each in %. Probit estimates based mostly on 1986-2018 (pre-pandemic). NBER outlined peak-to-trough recession dates shaded grey. Supply: WSJ, NBER, creator’s calculations.

Be aware that within the run-up to the 2007-09 recession, the probit mannequin lead the survey measure, whereas probit and survey rose in tandem by end-2022, diverging thereafter.