Forecast finalized in November (roughly similar time as CBO’s projections, launched in February).

First, GDP:

Determine 1: GDP (black), Administration forecast (pink squares), CBO projection (tan), February Survey of Skilled Forecasters (blue), GDPNow of March 7 (gentle inexperienced sq.), all in billions Ch.2017$ SAAR. Ranges of GDP in Administration and GDPNow calculated utilizing progress charges and ranges of GDP obtainable at time of forecast/nowcast. Supply: BEA 2023Q4 2nd launch, CBO (February), Philadelphia Fed (February), OMB (March), and Atlanta Fed (March 7), and writer’s calculations.

Given the same info units obtainable at early November when the 2 forecasts had been generated, it’s not stunning the Administration and CBO have an identical outlook on GDP, even taking the truth that CBO’s projection is conditioned on present regulation, and the Administration’s is conditioned on the President’s finances. In actual fact, the Administration’s GDP forecast is nearly indistinguishable from the November SPF for 2023 and 2024.

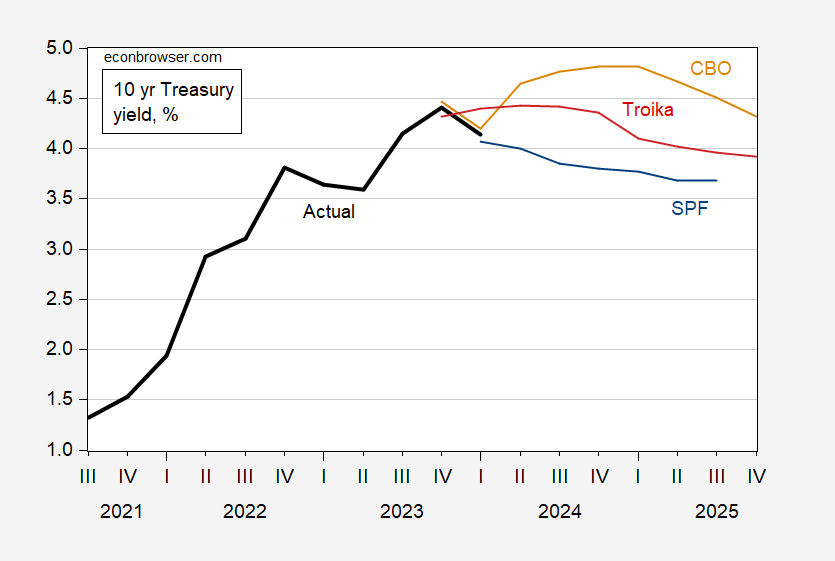

Each the CBO and the Administration forecast increased 10 yr Treasury yields than economists within the SPF. (The Administration trajectory is a quadratic interpolation to quarterly knowledge, because the Funds solely stories annual yields.)

Determine 2: Ten yr Treasury yields (black), Administration forecast (pink line), CBO projection (tan), February Survey of Skilled Forecasters (blue), all in %. 2024Q1 precise yield relies on January and February knowledge. Administration quarterly forecasts interpolated from annual knowledge utilizing quadratic match. Supply: Treasury by way of FRED, CBO (February), Philadelphia Fed (February), OMB (March), and writer’s calculations.

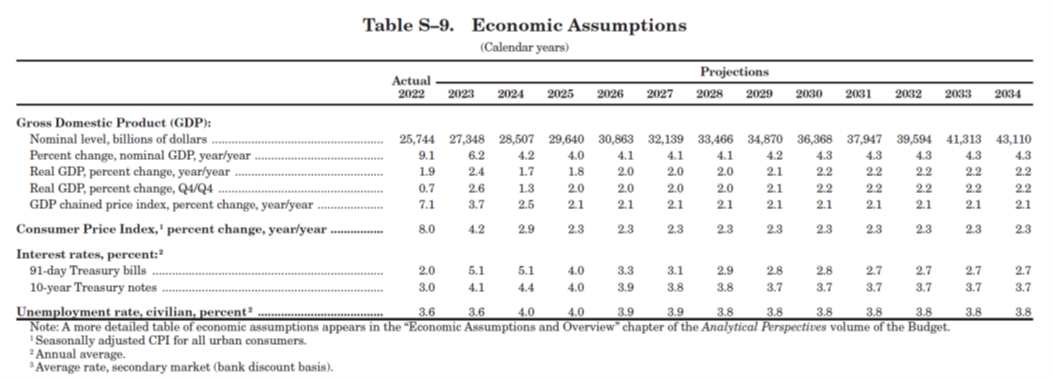

Right here’s the desk summarizing the forecasts.

Supply: OMB (2024).