GDPNow up from 2.5% on 10/1 to three.2% on 10/8 (q/q AR), on the idea of auto gross sales and employment state of affairs releases.

Supply: Atlanta Fed, accessed 10/8/2024.

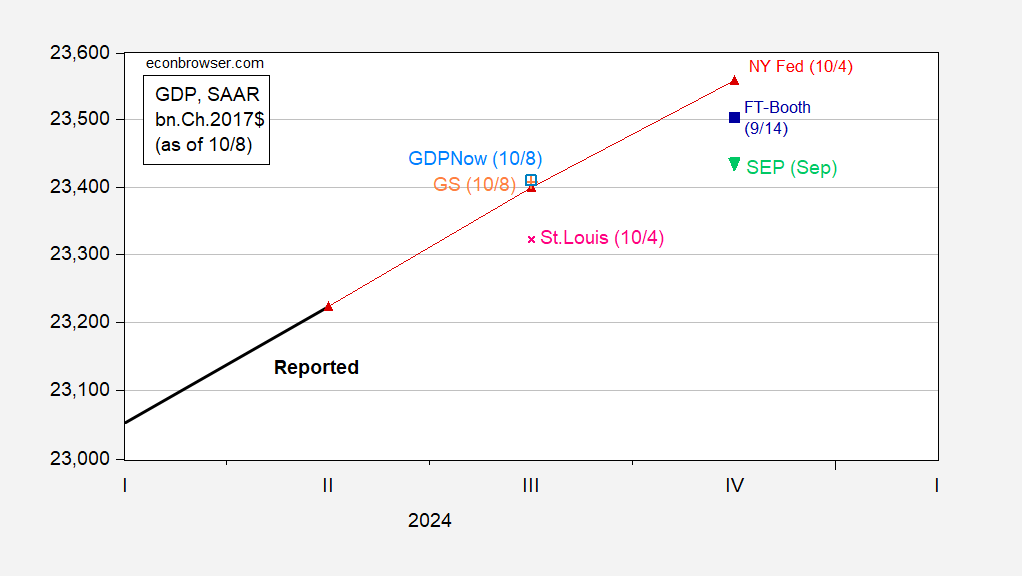

That is what different nowcasts/monitoring estimates are indicating.

Determine 4: GDP (daring black), Abstract of Financial Projections median iterated off of third launch (inverted gentle inexperienced triangle), GDPNow as of 10/8 (gentle blue open sq.), NY Fed nowcast as of 9/20 (crimson triangles), St Louis Fed information nowcast as of 10/4 (pink x), Goldman Sachs monitoring as of 10/8 (orange +), FT-Sales space as of 9/14 iterated off of third launch (blue sq.), all in bn.Ch.2017$ SAAR. Ranges calculated by iterating development fee on ranges of GDP, aside from Survey of Skilled Forecasters. Supply: BEA 2024Q2 third launch/annual replace, Atlanta Fed, NY Fed, Philadelphia Fed, Federal Reserve September 2024 SEP and writer’s calculations.

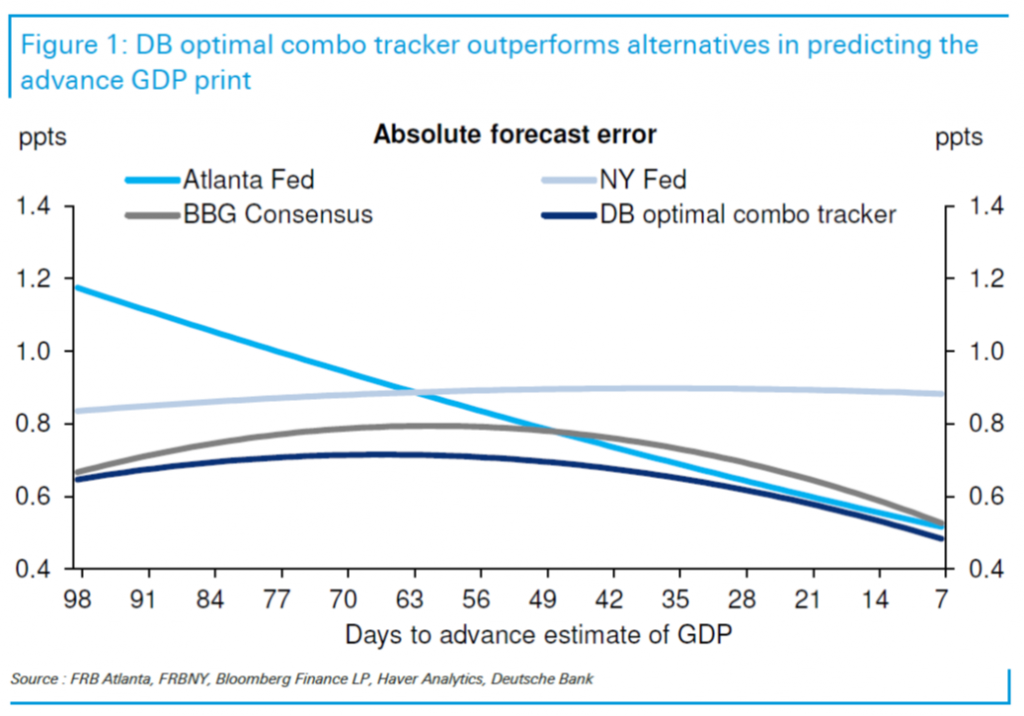

At 22 days to the 2024Q3 advance launch (on October 30), the Atlanta Fed’s GDPNow has been about as correct because the Bloomberg consensus, no less than in pre-pandemic days. Right here’s DeutscheBank’s 2019 comparability.

Supply: Luzzetti, et al. “Monitoring the GDP trackers,” Deutsche Financial institution US Financial Views, 24 July 2019.

The NY Fed nowcast has been considerably revamped, so the MAE numbers proven above are now not related.

For what it’s value, Polymetrics locations odds of a detrimental 2024Q3 advance launch at 2% as of 1:14 CT.