I’ve delayed reviewing this portion of chapter 26 of the Undertaking 2025 as a result of I knew it will be painful to learn. However because the election nears, it’s incumbent upon all of us to take up our burdens in help of fine coverage. So right here is a few key textual content from this portion of the chapter, written by my onetime (40-42 years in the past) coauthor Peter Navarro (the second portion, “The case totally free commerce” by Kent Lassman is a helpful orthodox therapy of commerce coverage).

America of America is the world’s dominant superpower and stays

the world’s arsenal of democracy. To keep up that international positioning—and thereby

greatest defend the homeland and our personal democratic establishments—it’s essential that

america strengthen its manufacturing and protection industrial base on the

similar time that it will increase the reliability and resilience of its globally dispersed

provide chains. That can essentially require the onshoring of a good portion

of manufacturing presently offshored by American multinational firms.

Commerce coverage can and should play a necessary function in an American manufacturing

and protection industrial base renaissance. Nevertheless, a number of main challenges within the

worldwide buying and selling setting are pushing America in the other way.

The primary problem is rooted in MFN: the “most favored nation” rule of the World

Commerce Group (WTO). In keeping with the MFN rule, WTO members should apply

the bottom tariffs that they apply to the merchandise of anybody nation to the merchandise

of each different nation.3 Nevertheless, WTO members can cost increased tariffs in the event that they

apply these nonreciprocal tariffs to all international locations.

The sensible consequence has been the systematic exploitation of American farmers,

ranchers, producers, and staff by way of increased tariffs institutionalized by

MFN. In flip, this unfair and nonreciprocal commerce has resulted in persistent U.S. commerce

deficits with a lot of the remainder of the world. This systemic commerce imbalance serves as

a brake and bridle on each GDP progress and actual wages within the American financial system

whereas encumbering the U.S. with vital international debt.

The second problem is a part of the broader existential risk posed by the

Chinese language Communist Celebration (CCP) in its quest for international dominance. That problem

is rooted within the CCP’s continued financial aggression, which begins with

mercantilist and protectionist commerce coverage instruments reminiscent of tariffs, nontariff limitations,

dumping, counterfeiting and piracy, and foreign money manipulation. Nevertheless, Communist

China’s financial aggression additionally extends to an intricate set of business

insurance policies and expertise switch–forcing insurance policies which have dramatically skewed

the worldwide buying and selling area.

Each the unfair, unbalanced, and nonreciprocal commerce institutionalized by the

WTO and Communist China’s financial aggression are weakening America’s manufacturing

and protection industrial base even because the fragility of worldwide dispersed

provide chains has been introduced into sharp reduction by the COVID-19 pandemic with

its related lockdowns and different disruptions and by the Russian invasion of

Ukraine. Russian revanchism, particularly, has demonstrated as soon as once more how dangerous

actors on the world stage can use commerce coverage (for instance, export restraints on

pure fuel) as a weapon of warfare.

At this level, the writer launches right into a dialogue of how commerce deficits are prima facie proof that the US has deindustrialized, particularly these industries essential to nationwide safety.

Through the first 12 months of the Biden Administration, the general U.S. commerce deficit,

together with items and companies, soared by 29 p.c, from $654 billion in 2020

to $845 billion in 2021.4 Over the identical time interval, imports of shopper items, capital items, and the class of meals, feeds, and drinks have been the best on

report, and imports of business provides and supplies have been the best since 2014.

As for the U.S. commerce deficit in items, which primarily measures manufacturing

output, Desk 1 catalogues that deficit for the highest 13 international locations plus the European

Union (EU) in fiscal 12 months (FY) 2022. Notice that the commerce deficit in items with Communist

China is by far the biggest: It accounts for absolutely one-third of that deficit and

is greater than twice the dimensions of the deficit with the EU.

These commerce deficit statistics implicitly measure the big quantities of America’s

manufacturing and protection industrial base and provide chains which have been

offshored to international lands.

As Robert Z. Lawrence as soon as remarked to me as I used to be writing a memo on the commerce deficit, we’re all the time going to have information as a result of nominal portions are sometimes rising… Right here’s an image of the commerce deficit normalized by GDP:

Determine 1: Web exports to GDP. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER.

As this image exhibits, on a NIPA foundation, the commerce deficit was bigger as a share of GDP after Trump than earlier than Trump. This was additionally true after Trump vs. initially of the commerce warfare, in Q2 2018.

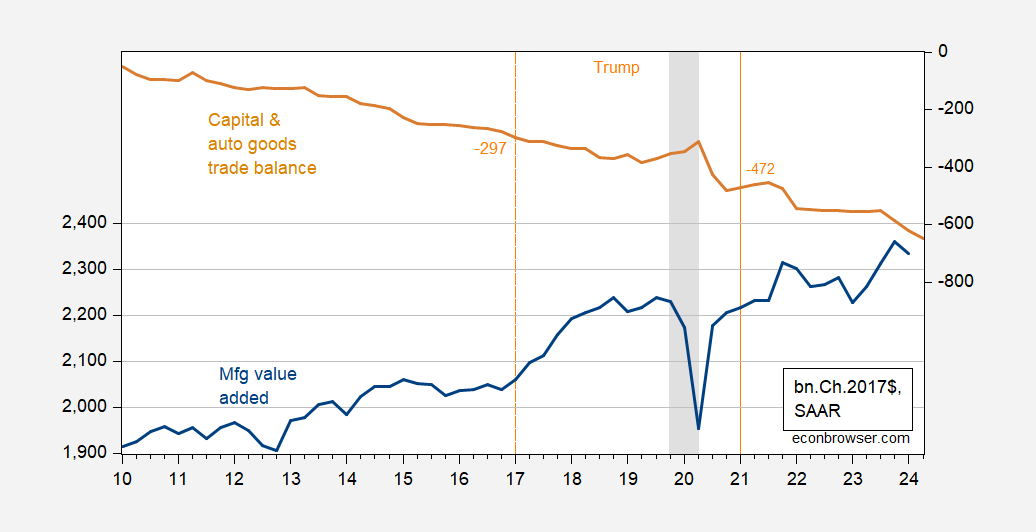

Navarro additionally argues that the manufacturing base was smaller due to the commerce deficit in manufactured items. I plot manufacturing worth added vs. the capital items + automotive commerce stability (all in 2017$).

Determine 2: Manufacturing worth added (blue, left scale), commerce stability on capital and automotive items (tan, proper scale), each in bn.Ch.2017$ SAAR. Manufacturing worth added in 2012$ spliced to collection in 20176$ by writer. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA and writer’s calculations.

There’s no apparent relationship (at enterprise cycle frequency) for a relationship between the capital and automotive items commerce stability and worth added in manufacturing. Perhaps worth added would’ve been better within the absence of the commerce deficit, ceteris paribus. nevertheless, possibly it will’ve been bigger, given imported (cheaper) inputs enable better manufacturing.

In any case, the proposed treatment for the perceived imbalance is the US Reciprocal Commerce Act, summarized by CRS thusly:

United States Reciprocal Commerce Act

This invoice permits the President, in sure circumstances, to (1) negotiate with a international nation for tariff reductions on exported U.S. items, or (2) impose extra duties on imported items. Particularly, the President might take these actions whether it is decided that the nation (1) when importing a very good from america, applies the next price of obligation on that good than the speed imposed by america when imported from that nation; or (2) equally imposes different, nontariff commerce restrictions on that good.

The President should terminate a price of obligation enhance underneath this invoice if the nation now not applies such increased charges or nontariff commerce restrictions, or if the upper price is now not within the curiosity of america.

Congress might nullify a price of obligation enhance carried out underneath this invoice by way of a joint decision.

This invoice is efficient for 3 years, topic to 1 three-year renewal.

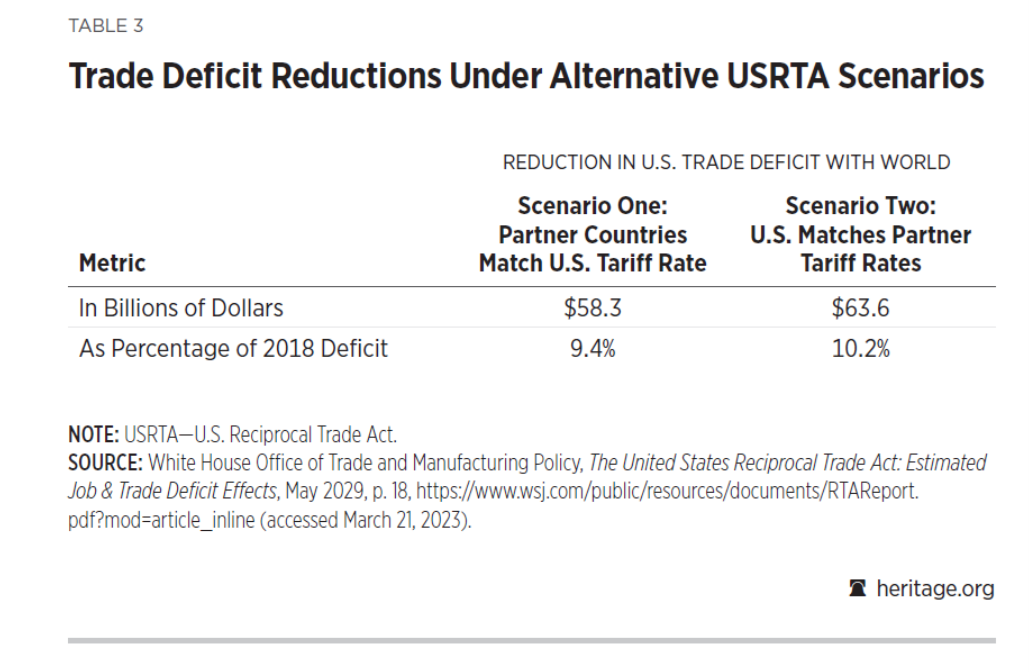

Navarro cites the simulations run by his workplace, utilizing the World Financial institution’s SMART tariff simulator.

One in Desk 3 assumes that our buying and selling companions decrease their utilized tariff charges on particular merchandise to U.S. ranges in instances the place their utilized tariffs are increased. Situation Two assumes that our buying and selling companions refuse to decrease their tariff charges to match these of the U.S. As a substitute, with the intention to uphold the precept of reciprocity, the U.S. raises its tariffs to reflect ranges. To calculate the commerce deficit reductions underneath Situation One and Situation Two, the evaluation relied on the World Financial institution’s SMART tariff simulator. Desk 3 offers the simulation outcomes.

In Situation One, if all 132 international locations have been to decrease their increased nonreciprocal tariffs to U.S. ranges, the general U.S. commerce deficit in items could be decreased by $58.3 billion, or about 9.4 p.c of that deficit. In distinction, in Situation Two, if these international locations have been to refuse to reciprocate and the U.S. have been to lift its tariffs to reflect these international locations’ ranges, the discount within the U.S. commerce deficit could be barely bigger: an estimated $63.6 billion, or 10.2 p.c of the deficit. This means that implementing the USRTA would assist to create between 350,000

and 380,000 jobs.

Right here’s Desk 3:

SMART is a device inside the World Financial institution’s World Built-in Commerce System (WITS). It’s partial equilibrium, in order the tariffs change general financial output, and different macro aggregates and costs (together with alternate charges) keep mounted. That is positive for adjustments in tariffs overlaying small quantities of imports. Not so for giant adjustments in tariffs on most items.

I’d say for such widespread tariff will increase, it’s more likely to see large macro adjustments, as we noticed within the wake of the 2018 commerce warfare. In 2018, the worldwide EPU rose 60%; the elasticity of the true worth of the greenback with respect to the worldwide EPU is 0.2. That means 12 ppts of the greenback’s power in 2018 was attributable to the coverage uncertainty spurred by the Trump commerce warfare. Say a Trump commerce warfare 2.0 induces a EPU leap of comparable magnitude; this could indicate a 12 ppt enhance within the worth of the greenback, a lot of any expenditure switching coming from increased tariff charges. Utilizing estimates from Chinn (2004), the greenback appreciation alone would trigger a $455 billion greenback (SAAR) enhance within the commerce deficit (utilizing 2024Q2 figures). 2024Q2 web exports are about -$894 billion.

For the sake of argument, suppose the impacts are additive. the $455 billion dwarfs the $63 odd billions from the SMART simulation (take it as much as $70 billion to account for traded items worth inflation).

The opposite portion of Navarro’s portion of the chapter offers with how China cheats and poses a nationwide safety risk to america. Really, I agree that China commerce and financial insurance policies distort commerce (notably specific and implicit subsidies to state owned enterprises), and much more in order that China poses a nationwide safety risk in its competitors in excessive tech. I’ll handle a few of these considerations (once more) in one other put up. Suffice to say, I believe tariffs and different NTBs (as utilized in Trump commerce warfare 1.0) are most likely too blunt and inefficient methods to take care of these threats.

For now, let me finish with the next conclusions, which I largely agree with.

Nationwide Safety Advantages and Prices. On the profit aspect, protectionism inside sure fundamental industries like autos, metal, and electronics helps to create and maintain and industrial base that, in occasions of warfare or nationwide peril, may be shifted to protection functions. Nevertheless, this nationwide safety argument–and the existence of any advantages ensuing from defending these industries–can legitimately be referred to as into query for a number of causes.

First, the existence of any sizable advantages rests on the assumptions that import competitors in our defense-related industries wouldn’t solely scale back the dimensions of those industries but in addition shrink them to the purpose the place they’d be too small to help our protection wants…

Second, it’s extremely potential that our protection functionality may truly be enhanced–not damaged-by import competitors. With out the umbrella of protectionism, our defense-related industries could be compelled to function at lowest price, have interaction in additional analysis and growth, aggressively innovate to remain one step forward of the competitors, and modernize their crops at a sooner tempo. …

On the nationwide safety price aspect, the main impact of protectionism is to threaten the soundness of the worldwide financial order by way of a worldwide commerce warfare. …

That excerpt is from Peter Navarro, The Coverage Recreation (Wiley, 1984), p.82, on the nationwide safety/commerce coverage nexus.