That’s EJ Antoni/Heritage Basis, writing in September 2022. A cautionary word on declaring recessions.

Moreover, the Biden administration’s cherry-picking of knowledge has come again to chew it, with even its chosen knowledge factors now being revised to point a recession. And whereas these numbers verify the economic system shrank within the first half of the 12 months, the remainder of this 12 months holds little promise of restoration.

Only a reminder of what knowledge we all know now about 2022H1, and what occurred subsequently.

Determine 1: Nonfarm Payroll employment (daring darkish blue), Bloomberg consensus of two/1 (blue +), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, 2023Q4 advance launch (blue bars), all log normalized to 2021M11=0. Hypothesized 2022H1 recession shaded gentle blue. Supply: BEA, BLS by way of FRED, Federal Reserve, 2023Q4 advance launch,, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/1/2024 launch), and writer’s calculations.

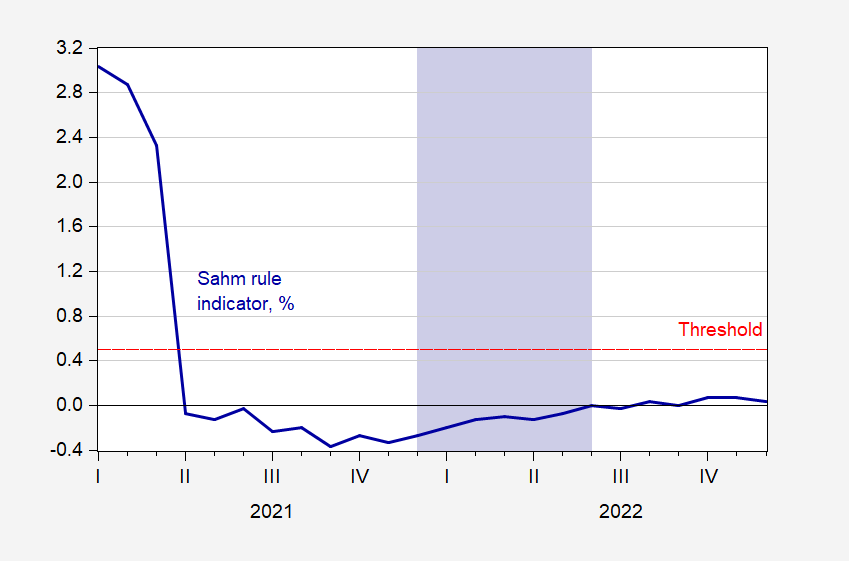

What in regards to the Sahm rule (actual time)?

Determine 2: Actual time Sahm rule indicator, in % (blue). Threshold denoted by crimson dashed line. Putative peak-to-trough recession of 2022H1 shaded lilac. Supply: FRED.

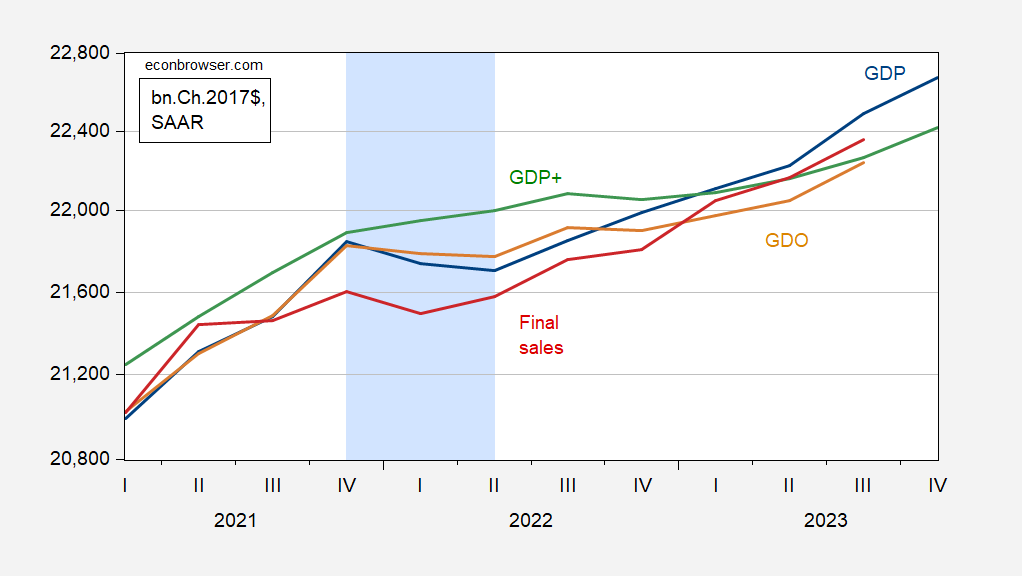

And, recalling that NBER’s BCDC doesn’t place main reliance on GDP, listed below are different measures of output.

Determine 3: GDP (blue), GDO (tan), and GDP+ (inexperienced), last gross sales (crimson), all in bn.Ch.2017$ SAAR. GDP+ assumes 2019Q4 GDP+ equals GDP. Hypothesized 2022H1 recession shaded gentle blue. Supply: BEA 2023Q4 advance estimate, Philadelphia Fed, and writer’s calculations.

So, now Dr. Antoni has declared us in recession, as of a number of weeks in the past. He would possibly find yourself being proper. As of yesterday, nowcasts are rising, the Lewis-Mertens-Inventory Weekly Financial Index is working at 2.37%.