This Thursday 4:30 CT at UW:

Description:

The tempo of China’s financial progress since 1978 is unprecedented. The nationwide safety technique of america requires sustaining a sturdy aggressive edge over China.

Whereas US officers now wish to characterize the purpose of financial coverage towards China as derisking, the proliferation of tariffs on Chinese language items and an ever widening web of export controls suggests the combo is evolving towards decoupling. The prices and dangers of this technique for america are prone to be substantial. China is a big market for a lot of main US expertise companies. If gross sales of those companies are more and more curtailed by export controls, how will these companies maintain the R&D expenditures required to maintain their technological lead? Extra typically what are the implications if america curtails financial alternate with what stays the world’s quickest rising massive economic system?

Biography:

Nicholas R. Lardy, known as “everyone’s guru on China” by the Nationwide Journal, is a nonresident senior fellow on the Peterson Institute for Worldwide Economics. He joined the Institute in March 2003 from the Brookings Establishment, the place he was a senior fellow from 1995 till 2003. He was the director of the Henry M. Jackson Faculty of Worldwide Research on the College of Washington from 1991 to 1995. From 1997 by means of the spring of 2000, he was additionally the Frederick Frank Adjunct Professor of Worldwide Commerce and Finance on the Yale College Faculty of Administration. He’s writer, coauthor, or editor of quite a few books, together with The State Strikes Again: The Finish of Financial Reforms in China? (2019), Markets over Mao: The Rise of Non-public Enterprise in China (2014), Sustaining China’s Financial Progress after the International Monetary Disaster (2012), The Way forward for China’s Alternate Fee Coverage (2009), China’s Rise: Challenges and Alternatives (2008), Debating China’s Alternate Fee Coverage (2008), and China: The Steadiness Sheet—What the World Must Know Now in regards to the Rising Superpower (2006). Lardy is a member of the Council on International Relations and of the editorial boards of Asia Coverage and the China Assessment.

College of Wisconsin-Madison sponsors of this occasion:

- Heart for East Asian Research

- Heart for Analysis on the Wisconsin Financial system

- East Asian Authorized Research Heart

- Robert M. La Follette Faculty of Public Affairs

- Tommy G. Thompson Heart on Public Management

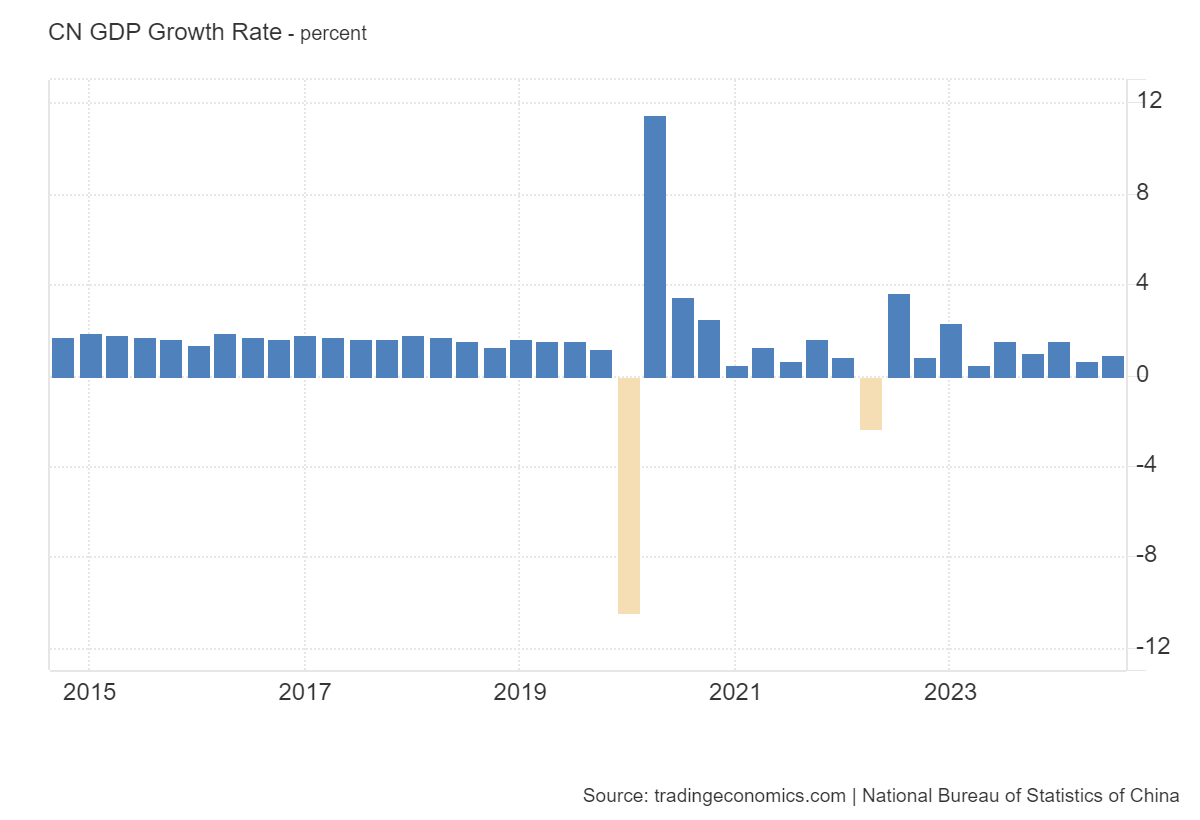

China GDP progress by means of Q3:

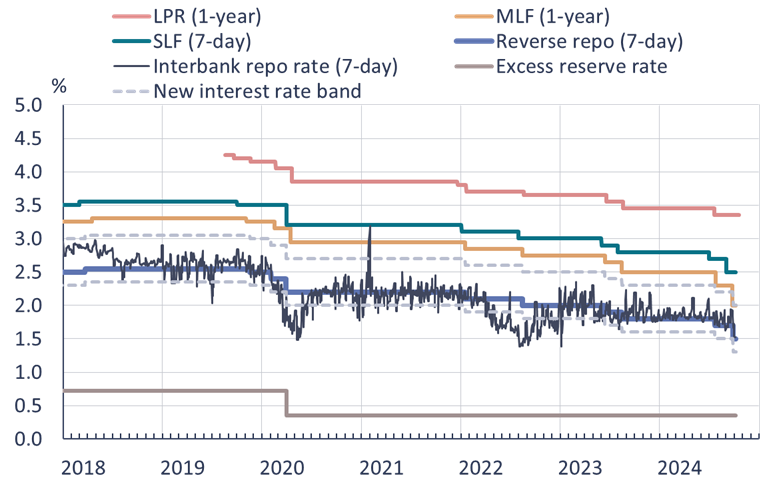

BOFIT critiques the latest stimulus measures:

My impression is that the failure of the CCP to roll out higher fiscal stimulus signifies that one shouldn’t count on an enormous cyclical rebound (and positively not one of the measures introduced and even contemplated the components affecting the secular pattern, together with more and more statist insurance policies in pursuit of different targets). To wit, from Natixis in the present day:

• Two main developments have adopted the Third Plenum in July. First, a sequence of financial information releases indicated that the plenum had performed nothing to enhance the nation’s short-term outlook. Second, a sequence of stimulus measures have been introduced over a two-week interval, which have thus far didn’t reinvigorate the economic system.

• The federal government is unlikely to enact the reforms essential to help consumption on account of excessive public debt and restricted fiscal capability, as doing so would require reducing subsidies central to the nation’s industrial coverage. This could contradict Xi Jinping’s concentrate on innovation.

• The Folks’s Financial institution of China might must proceed interventions in each the sovereign bond market and the inventory market, although this might cut back international investor curiosity in Chinese language monetary markets.

• The federal government’s stimulus measures thus far have largely been geared toward stabilizing asset costs fairly than addressing the deeper problems with demand and overcapacity.

I don’t assume Lardy essentially agrees with this viewpoint (nor the lagging consumption story basically), which is why it’s a good suggestion to hear!