S. Ren in Bloomberg: “It’s getting flatter, prompting worries over an ‘asset famine’ and a chronic recession.”

Regardless of the motive, an inverted yield curve has a nasty rap. In regular instances, notes with longer maturities provide greater charges to compensate lenders for tying up their cash for an prolonged interval. When these yields sink near or beneath shorter ones, it’s a sign that traders are pessimistic about an economic system’s progress prospects. Within the US, an inversion was a dependable predictor of recessions, no less than within the pre-pandemic days.

Right here’s an image of the Chinese language yield curve as of at present:

Supply: WorldGovernmentBonds.com.

There’s no inversion at maturities 1 12 months to 30. Nonetheless, the 10yr-3mo unfold is inverted.

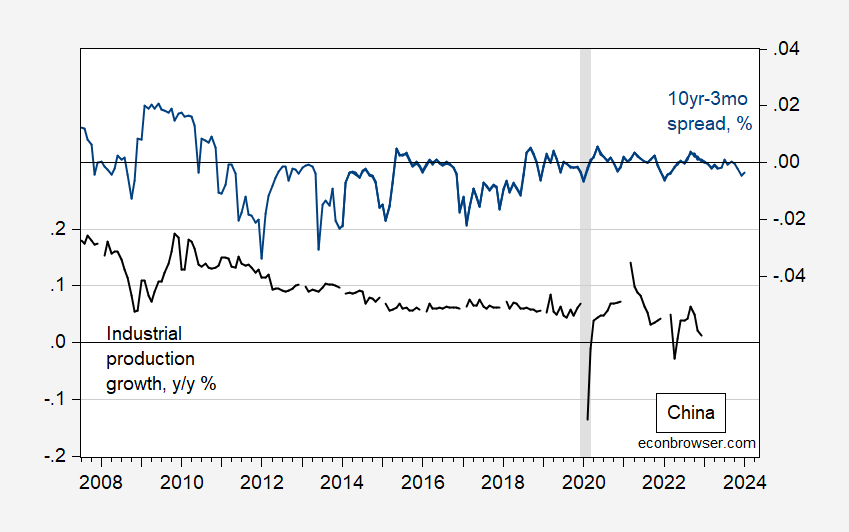

Determine 1: Chinese language year-on-year industrial manufacturing progress (black, left scale), and 10yr-3mo unfold (blue, proper scale). ECRI outlined peak-to-trough recession dates shaded grey. Supply: OECD, and writer’s calculations.

Chinn and Ferrara (2024) study the predictability of Chinese language recessions and industrial manufacturing progress. Within the former, no outcomes will be obtained, given the paucity of recessions in periods when long run rates of interest can be found (or related, given monetary repression). For y/y industrial manufacturing progress, we acquire:

ipgrowth = 0.095 + 1.66 × unfold

Adj-R2 = 0.26, NObs = 131, Pattern = 2007M07-2018M12 (progress to 2019M12). Daring signifies significance at 10% msl utilizing HAC sturdy normal errors.

Whereas there’s a statistically important constructive affiliation between the unfold and progress, it’s not a significant explanatory issue. That is maybe unsurprising insofar as the long run authorities bond market in China shouldn’t be very liquid. The long run bond yield is strongly associated to anticipated future brief charges (i.e., the expectations speculation of the time period construction) if the long run marked is liquid.

Including in further monetary elements — particularly the debt service ratio and international time period unfold — will increase the adjusted R2 to about 0.77.

ipgrowth = 0.237 + 0.32 × unfold – 0.98 × dsr + 1.44 × unfold*

Adj-R2 = 0.77, NObs = 131, Pattern = 2007M07-2018M12 (progress to 2019M12). Daring signifies significance at 10% msl utilizing HAC sturdy normal errors.

Whereas the unfold stays marginally important, when it comes to standardized coefficients, the debt-service ratio and international time period time period unfold are extra impactful (7 and three instances greater than time period unfold, respectively).

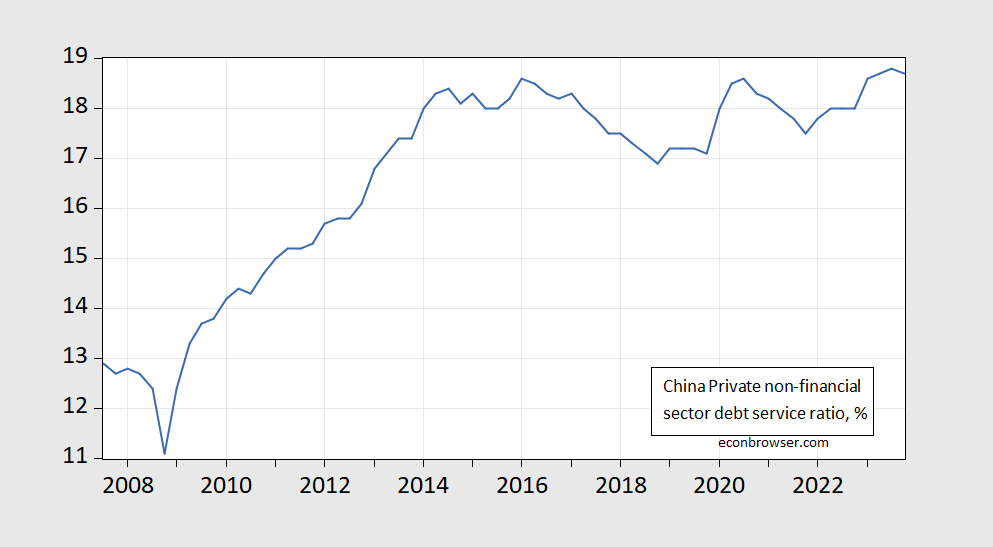

Right here’s the BIS sequence for personal nonfinancial sector debt service ratio, by means of 2023.

Determine 2: Chinese language personal nonfinancial sector debt service ratio, %. Supply: BIS.

For alerts of an impending recession — or recession — look to different indicators.

Earlier put up on China, right here.