Peter Schiff right now:

This morning has seen a trifecta of weak financial information. Aug. PMI & ISM manufacturing each got here out even weaker than anticipated, whereas July development spending unexpectedly fell. It’s changing into clear the #financial system is getting into a #recession simply as #inflation is poised to show larger.

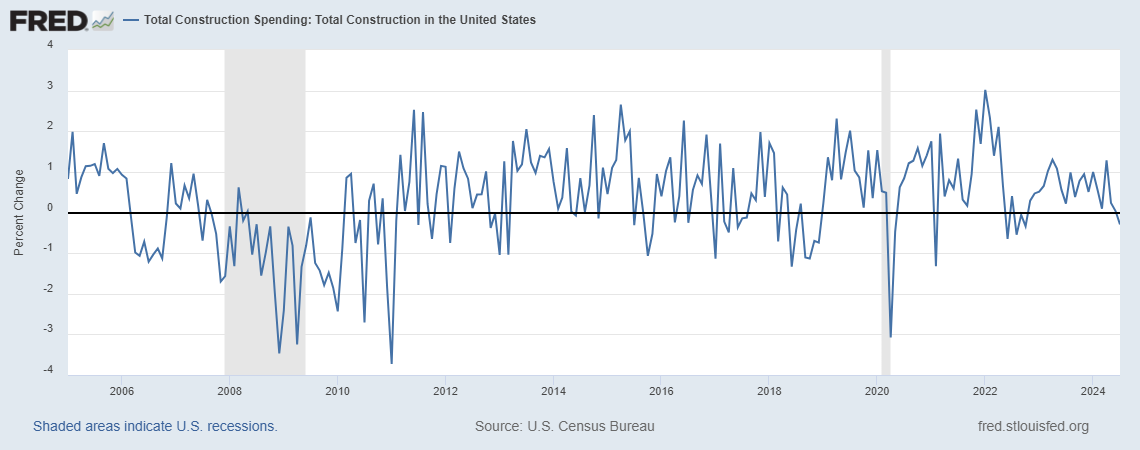

Bloomberg signifies manufacturing PMI was 47.9 vs consensus 48, ISM manufacturing was 47.2 vs. 47.5 consensus. Over the past 12 months, the usual deviation of forecast errors is 0.5, so the -0.3 shock isn’t statistically considerably completely different from common shock of 0.17. Development spending was down 0.3% m/m vs +0.1% consensus. The usual deviation of errors is 0.4 ppts, so as soon as once more the drop is inside one commonplace deviation and never statistically considerably completely different from zero.

As for development spending:

Goldman Sachs feedback:

. Nominal development spending decreased by 0.3% (mother sa) in July, in opposition to expectations for a 0.1% enhance. Spending progress was revised up in June (+0.3pp to flat) and Could (+0.6pp to +0.2%). Non-public development spending declined by 0.4% in July, as non-public residential spending (-0.4%) and personal nonresidential spending (-0.4%) each decreased. Public development spending edged up in July (+0.1%), reflecting a rise in public nonresidential spending (+0.2%) however a lower in public residential spending (-2.6%). Development prices elevated by 0.6% in July (mother sa, Census measure), indicating that development spending decreased 0.9% in actual phrases.

Perhaps recession is coming. Undecided these releases a persuasive. Notice: Mr. Schiff has been predicting recession since November 2023.