Extra articles on greenback dominance, e.g. in Overseas Coverage, Wells Fargo, vs. BitcoinNews. However a lot of the dialogue facilities on greenback use in phrases medium of alternate and so on. (SWIFT use, invoicing). Right here, some current traits for the reserve dimension.

Listed below are some footage of key reserve currencies held by the BRICS.

Determine 1: Share of overseas alternate holdings in USD, by central financial institution. Supply: Ito-McCauley database,.

Subsequent, EUR holdings shares; be aware the change in scale.

Determine 2: Share of overseas alternate holdings in EUR, by central financial institution. Supply: Ito-McCauley database,.

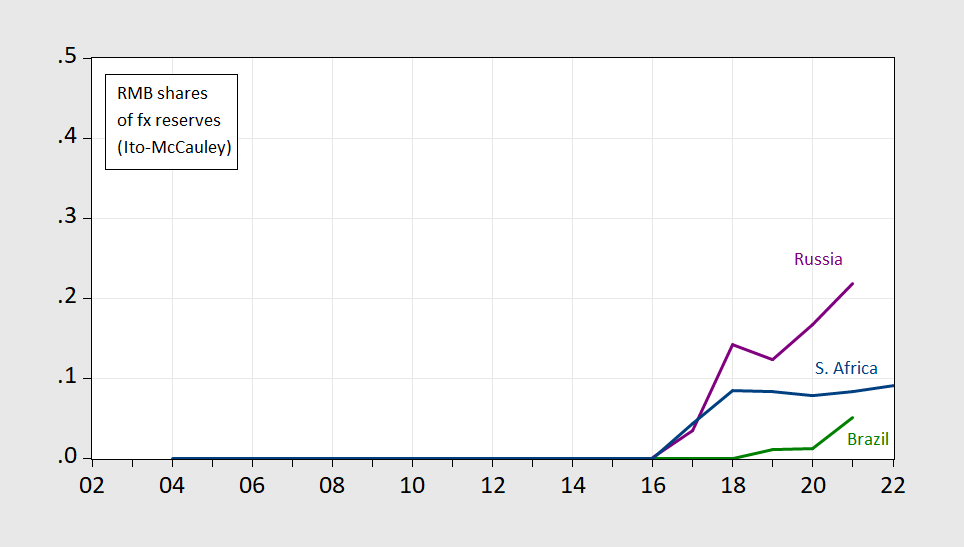

The holdings of USD exhibit a pointy drop just for Russia. What concerning the RMB? We’ve got fairly restricted data right here.

Determine 3: Share of overseas alternate holdings in RMB, by central financial institution. Supply: Ito-McCauley database,.

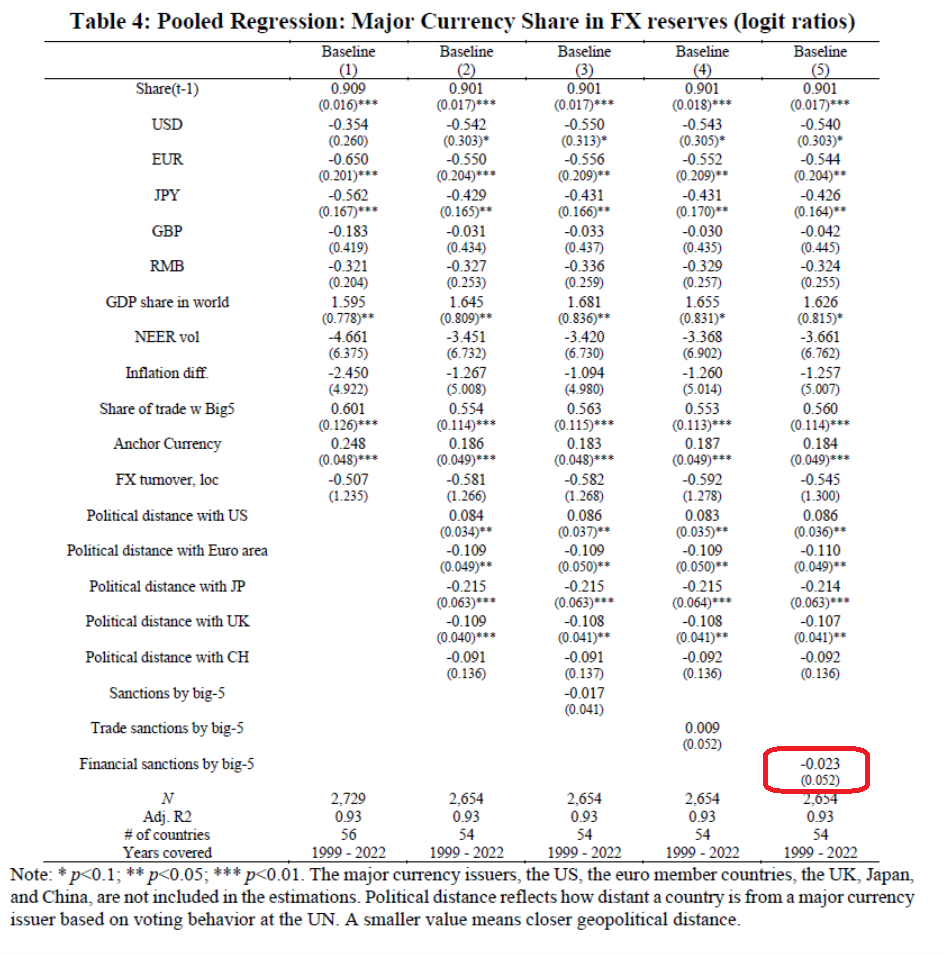

Will implementation of sanctions lead to lowered greenback holdings? Sadly, we don’t have knowledge for the interval after the expanded invasion of the Ukraine, however we do have estimates encompassing as much as 2021.

Supply: Chinn, Frankel and Ito (JIMF, 2024).

Be aware the estimated coefficient just isn’t statistically important. It’s additionally nonlinear, so a bit troublesome to interpret. Desk A1.1 within the paper presents estimates from a linear shares regression for USD holdings (solely), in order that the coefficient estimate is less complicated to interpret.

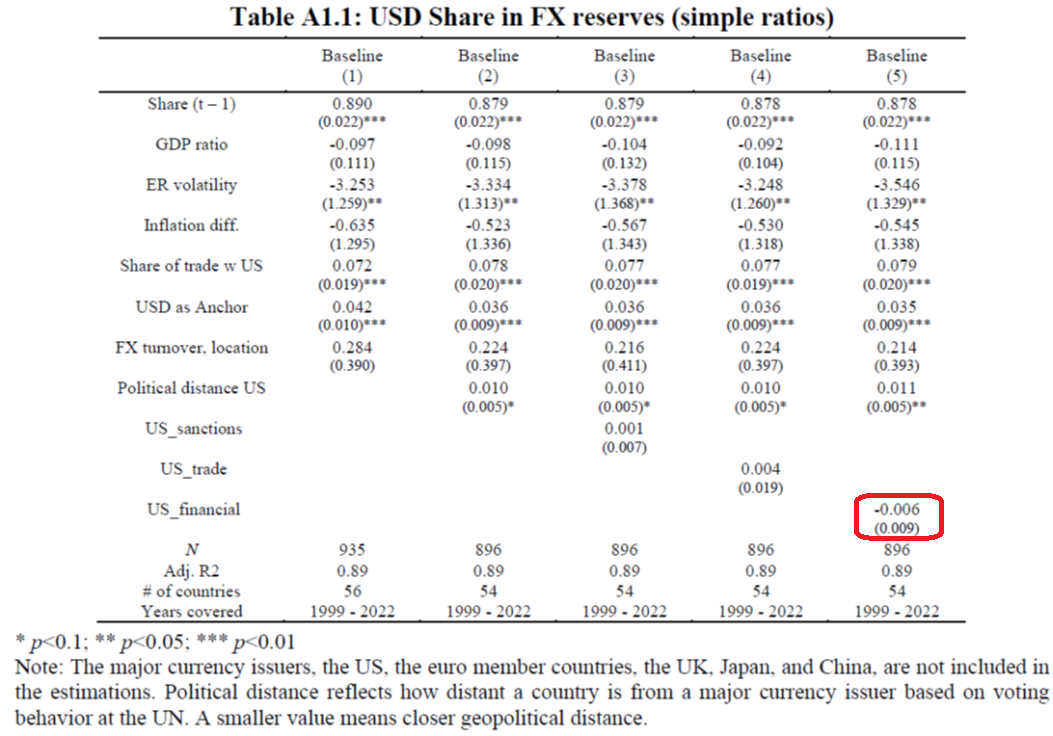

Supply: Chinn, Frankel and Ito (JIMF, 2024).

The purpose estimate may be very small (and not statistically important). Taken actually, with an autoregressive coefficient of 0.88, the future impression is 0.05, in order that if the US has imposed monetary sanctions on a rustic, on common that nation’s central financial institution will maintain 5 proportion factors much less US {dollars}. However, the 95% confidence interval encompasses a 6 proportion level improve in greenback shares.

Therefore, arguments that use of monetary sanctions will erode greenback dominance usually are not verified empirically, to date (possibly with knowledge to 2023, we might discover one thing completely different).