Mark Sobel at OMFIF discusses the probability of an new Plaza Accord to depreciate the greenback. Given one would want Euro space and Chinese language settlement, the assessed chances are low

A Mar-a-Lago Accord additionally can be inconsistent with Europe’s cyclical scenario. A devalued greenback can be tantamount to a stronger euro. That might be achieved by larger ECB rates of interest and/or fiscal growth in key European nations. However the ECB is now chopping charges given weak European economies and key nations reminiscent of Italy and France lack fiscal house.

G3 international trade market jawboning and interventions, absent modifications in fundamentals, are largely ineffective. After all, trade charges are pushed by your entire stability of funds, typically reflecting rate of interest differentials, and thus it’s virtually unimaginable to foresee how capital flows and trade charges would possibly reply to any accord.

Would China comply with an accord?

Trump’s ‘devaluation’ rhetoric is closely geared toward China. China was not a celebration to the Plaza Accord however it will must be central to a Mar-a-Lago Accord.

…

A weakening renminbi poses conundrums for Chinese language authorities. The renminbi is already falling in opposition to the greenback, in the direction of 7.3 at the moment, reflecting in massive measure normal greenback energy and anticipation of tariffs (Determine 1). However sharp depreciation in opposition to the greenback runs the danger of spawning a large one-way capital outflow as occurred in 2015-16, an expertise China doesn’t wish to see replicated. The authorities may need some temptation, nevertheless, to let the renminbi fall in a restrained method to offset the impression of tariffs and ship Trump a message.

This text spurred me to look at the US efficient trade price, measured utilizing (the conventionally used) CPI and unit labor prices (the latter extra related for evaluating “competitiveness” — see dialogue right here).

Determine 1: CPI deflated commerce weighted worth of US greenback (blue), and ULC deflated worth of US greenback(tan), each in logs 2000Q1=0. NBER outlined peak-to-trough recession dates shaded grey. CPI collection is Fed items commerce weighted collection spliced to items and companies commerce weighted collection at 2006M01. 2024Q4 commentary is for October-November. Supply: Federal Reserve Board, and OECD, each by way of FRED, NBER, and writer’s calculations.

So on each CPI deflated and ULC deflated (“competitiveness”) phrases, the greenback is certainly not as robust because it was within the mid-1980’s. So why the Trumpian fixation on the trade price? Are trade charges inessential to the commerce stability? I’d say no, having been the contributor to many papers on the elasticities method to commerce flows (see right here and right here). Nevertheless, I’d additionally say that on the medium run, personal saving relative to funding, and public saving (i.e., the finances stability) are going to be key determinants of the present account and not directly then the commerce stability (as within the IMF’s earlier Macroeconomic Stability method underlying CGER, and Chinn and Prasad (2003), and numerous Chinn-Ito papers [1] [2] [3] [4]).

The Trumpian thought of forcing a depreciation of the greenback will then possible have little medium time period impact on the commerce stability within the absence of one way or the other adjusting macroeconomic balances (admittedly, throwing the US economic system right into a recession would tank funding, (S-I) would improve and ceteris paribus the present account enhance).

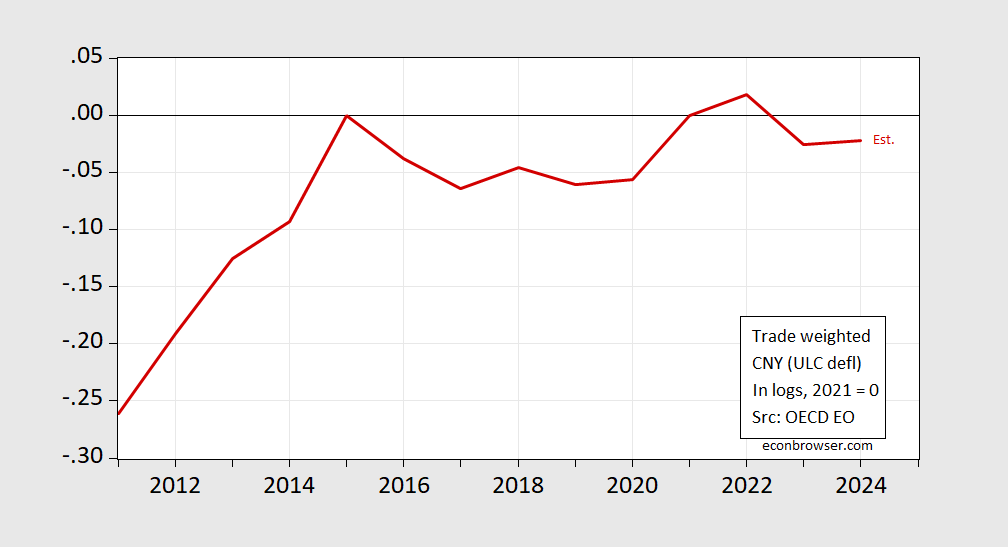

On the purpose that China is unlikely to let it’s foreign money recognize in opposition to the US greenback, it’s fascinating to examine not solely the CPI deflated yuan (as Sobel does), but additionally the ULC deflated yuan (this took some looking round):

Determine 2: ULC deflated worth of Chinese language yuan (purple), in logs 2021=0. ULC is economywide. 2024 commentary is forecast. Supply: OECD, Financial Outlook statistical appendix, December 2024.

The Chinese language are attempting to spur progress of their economic system, partially by spurring web exports. Appreciation works in opposition to this.

By the way in which, if certainly the Trump administration plans to slap a 60% tariff on China, simply keep in mind the usual deviation of the month-on-month change within the CNY/USD trade price (2018-2024) has been about 1.3% (not annualized). On the attainable price of capital flight, the Chinese language may enable substantial yuan depreciation, though as Sobel notes, a extra “managed” depreciation could be applied.

At a minimal, don’t count on a grand plan to rearrange euro and yuan appreciation.