Shoppers, CEO’s, or economists?

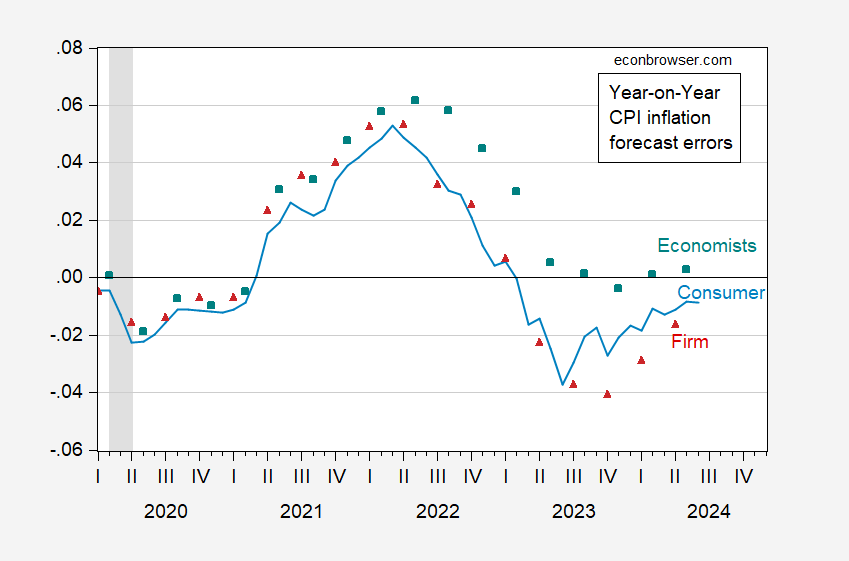

Determine 1: 12 months-on-12 months CPI inflation (daring black line), corresponding 1 12 months forward inflation expectation from NY Fed shopper survey (blue line), from Coibion-Gorodnichenko agency survey (purple triangle), from Survey of Skilled Forecasters (teal squares). NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS through FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER.

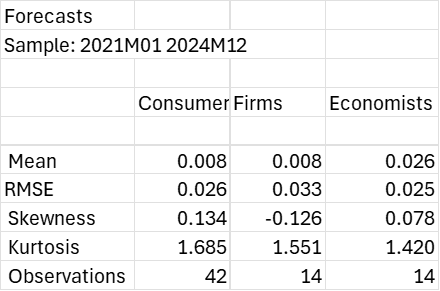

The forecast errors look as follows:

Determine 2: Forecast errors for 12 months-on-12 months CPI inflation and corresponding 1 12 months forward inflation expectation from NY Fed shopper survey (blue line), from Coibion-Gorodnichenko agency survey (purple triangle), from Survey of Skilled Forecasters (teal squares). NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS through FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER, and writer’s calculations.

Whereas skilled forecasters missed the inflation surge, they’ve hit the precise inflation from Might 2023 onward.

Whereas economists had been considerably biased of their expectations on this interval, underpredicting y/y inflation on the one 12 months horizon, the basis imply squared error (RMSE) of economists forecasts was decrease than that of corporations, and about the identical as that of customers. Of the three measures, solely the agency expectations fail to reject the no-bias null.

Then again, agency CEOs overpredict inflation into the most recent interval.

When it comes to adjusting forecasts in response to errors, customers are the slowest (as measured by the AR(3) of errors, at close to unity). Corporations are subsequent, at 0.89, and economists quickest at 0.81.