Continues to rise, in accordance the the Phildaelphia Fed’s coincident index, simply out. The divergence with GDP continues to persist.

Determine 1: Wisconsin Nonfarm Payroll Employment (darkish blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), actual wages and salaries linearly interpolated, deflated by nationwide chained CPI (sky blue), GDP (crimson), coincident index (inexperienced), all in logs 2021M11=0. Supply: BLS, BEA, Philadelphia Fed [1], [2], and creator’s calculations.

The three month annualized development fee of the Wisconsin coincident index is 3.7%; y/y it’s 1.2%.

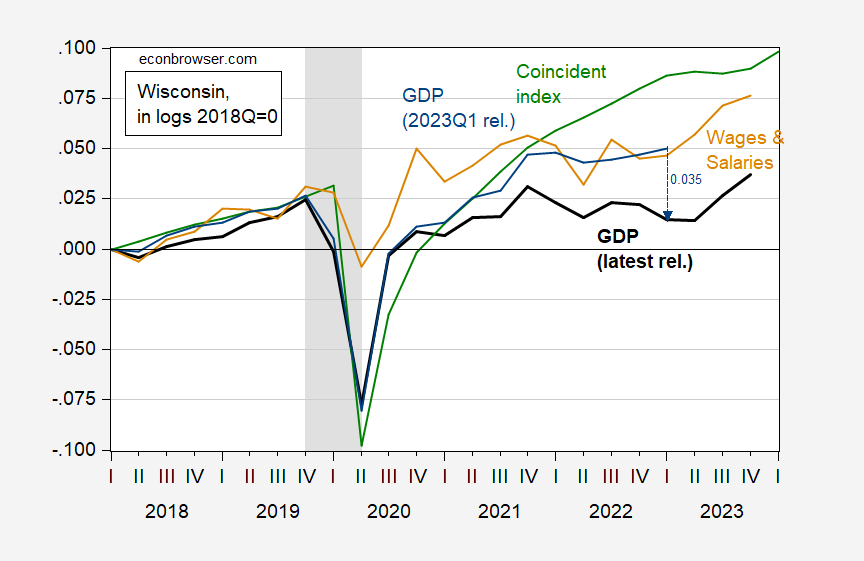

Word there’s a stark distinction between the GDP sequence, and the opposite sequence. The GDP sequence is calculated based mostly on the earnings definition of GDP, then utilizing nationwide degree sectoral worth added information to calculate the equal GDP. In truth, GDP as of the 2023Q1 launch was a lot increased, relative to 2018Q1, than the corresponding benchmark-revised information for the corresponding quarter. See the determine beneath:

Determine 2: GDP in Ch.2017$ (daring black), GDP in Ch.2012$ from 2023Q1 launch (blue), coincident index (inexperienced) and actual wages and salaries (tan), all in logs, 2018Q1=0. Wages and salaries deflated by nationwide Chained CPI adjusted by creator utilizing X-13. NBER outlined peak-to-trough nationwide recession dates shaded grey. BEA, BLS, Philadelphia Fed, NBER, and creator’s calculations.

What’s inflicting the hole between the latest estimates of Wisconsin GDP and the opposite indicators? I think it’s associated partly to the hole between GDI and GDP. On the nationwide degree, the hole is about 2% (in log phrases).

Replace, 1:41 Pacific:

I’ve an op-ed within the Milwaukee Journal Sentinel right now. I didn’t choose the title. I might’ve titled it “Wisconsinites are extra “meh” than one would anticipate from financial circumstances”.